World Bank Group, and Islamic Development Bank

CC BY 3.0 IGO

Article Overview

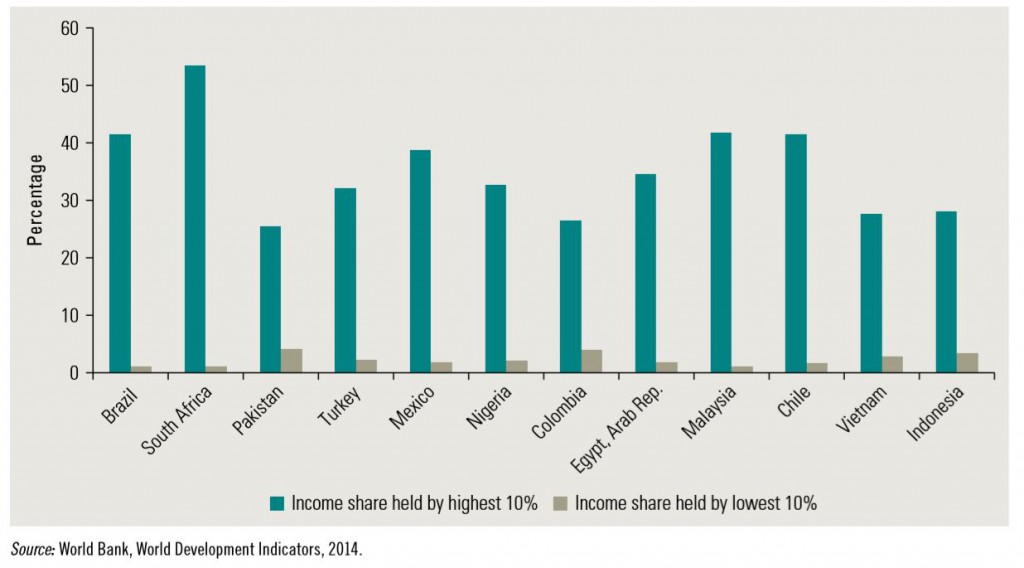

In recent decades, policy makers—including multilateral development organizations such as the World Bank Group—have often applied a “trickle-down” approach to reduce levels of absolute poverty. This approach asserts that higher productivity and industrial advancement lead to higher gross domestic product (GDP) growth in a country.

However, the immediate impact of such a growth-led policy could be an undesirable concentration of wealth in the hands of a few, while the growth benefits trickle down to the extremely poor only over a relatively long period of time. This approach has resulted in only partial success at the cost of social disequilibrium.

Professor Thomas Piketty’s influential 2013 book, Capital in the Twenty-First Century, highlighted the inequality in 20 countries during the past three centuries. The drastic deterioration in the distribution of wealth and income between the very rich and the very poor in the world is highlighted by a few striking facts:

- Almost half the world’s wealth is now owned by just 1 percent of the population (Working for the Few 2014).

- The richest 10 percent of the population hold 86 percent of the world’s wealth, and the top 1 percent alone account for 46 percent of global assets (Credit Suisse 2013).

- In the United States, the wealthiest 1 percent has captured 95 percent of growth since 2009, following the financial crisis, while the bottom 90 percent became poorer (Working for the Few 2014).

The Islamic perspective on income distribution shares many similarities with the asset-based approach to redistribution.8 The asset-based approach is basically a risk- sharing approach. It converges with Islamic finance’s contractual framework in terms of empowering equity participation by the lower-income groups in a society. Making the poor direct holders of real assets in the real sector of the economy reduces their high risk aversion.

It also creates positive incentives for behavior to enhance productivity (such as trust, truthfulness, and hard work) through the design of contracts that reduce or eliminate the difference between principals and agents and are conducive to achievement of interests of all parties to a contract. The foundations of human and economic development in Islam are well defined. The Islamic system of economics can be regarded as a rule-based system with well-defined principles, rules, and institutions. Compliance with this rule-based system leads to material and nonmaterial progress of society as a whole. The conventional perspective on economic development during the 1950s equated economic development with economic progress without taking into consideration the well-being of individuals.

This paradigm evolved and has shifted considerably during the past 50 years. Today, development economists acknowledge the importance of individuals as well as the state of institutions. The Islamic perspective on economic development encompasses this revised view. It has three dimensions: the development of the material world, self-development, and development of the society as a whole (Iqbal and Mirakhor 2013).

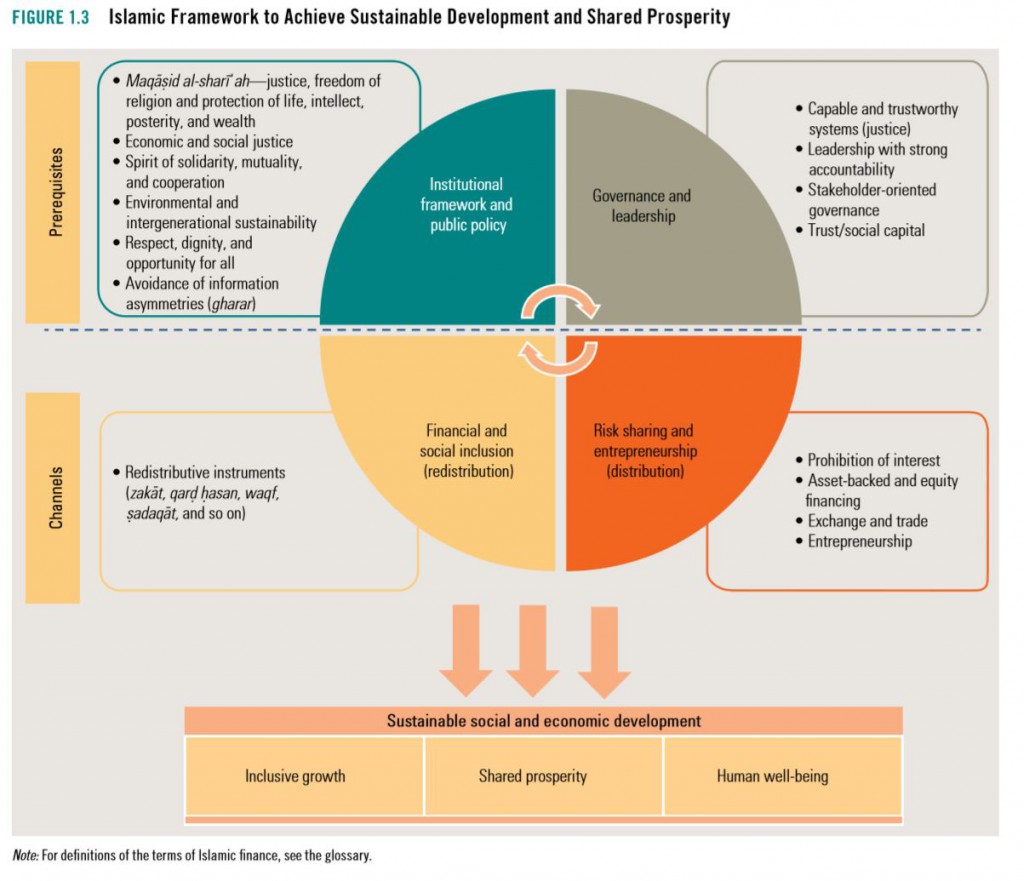

The central economic tenet of Islam is to develop a prosperous and egalitarian economic and social system wherein all members of society can maximize their intellectual capacity; preserve and promote their faith, health, and wealth among generations; and actively contribute to the economic and social development of society. From this perspective, Islamic economics and finance offer an alternative and viable framework that can play an important role in achieving sustainable development and boosting shared prosperity. This framework is based on four fundamental pillars, depicted in figure 1.3:

- An institutional framework and public policy in line with the objectives of Islam.

- Prudent governance and accountable leadership.

- Promotion of the economy based on risk sharing and entrepreneurship (distribution) 4. Financial and social inclusion for all (redistribution).

The first two pillars are prerequisites, while the last two are the channels to achieve sustainable development with equitable distribution of both opportunities and wealth, which are the main objectives of the concept of economic development in Islam. The proposed framework, which is constructed by interpreting central tenets of Islamic principles, could be used in creating a universal strategy and policy that align with the principles of Islamic finance to achieve the goal of sustainable development and to increase the welfare of all members of the society.

The first pillar is crucial because having a sound institutional framework and appropriate public policies are the foundation upon which the other pillars must rest and can function optimally. Institutions play a critical role in this framework, as they implement the rules prescribed by the tenets of Islam. The institutions also must adhere to the core objectives of Islam (commonly known as maqāṣid al-sharī‘ah, or Objectives of Islamic Law) that lay the foundation to formulate the policies promoting economic and social justice, preservation of human rights, dignity, health, and the intergenerational wealth of the society.

The second pillar focuses on developing a governance mechanism and accompanying compliance system based on the objectives and institutions briefly outlined in the first step. The ethically based governance, leadership, and compliance system helps increase the transparency and accountability in the public, private, and social sector institutions of the overall economic system and hence strengthens trust in the system. Trustworthy and capable leadership can ensure protection of rights of the vulnerable or those who could be vulnerable (as in future generations). Increased trust and better governance in turn strengthen the institutional framework that enables better implementation of better public policies. The desired institutional and governance structure must be able to do the following:

- Design policies to foster inclusive growth and development by promoting entrepreneurship, risk-sharing financial transactions, and equity participation, and by discouraging financial leverage and speculation.

- Encourage all members of society to contribute to the creation of economic, social, human, and moral capital.

- Enhance the equitable distribution of wealth by promoting sharing of both risk and rewards.

- Alleviate poverty by redistributing wealth, with special focus on the poorest.

- Achieve economic and social justice by the correct use of material growth and development that enhances the overall well-being of the society.

The third pillar is the distribution channel; it works at both the individual and organizational level. One of the main features is the advocacy of risk sharing and promotion of entrepreneurship. This is one of the most important aspects of Islamic finance, which differentiates it from the conventional approach of overreliance on debt-dominated risk-shifting or risk-transfer mechanisms.

Sharing the risks of economic and financial transactions also ensures the stability of the financial system (Askari and others 2010). In addition, risk sharing with equitable sharing mechanisms encourages entrepreneurship and innovation, since counterparties receive their fair share in the investment. This in turn will increase the allocation of resources to the real sector, rather than channeling excessive financial flows to the financial sector (overfinancialization).

The fourth pillar aims to ensure that the fruits of the higher growth are distributed to every segment of the society inclusively, either through participation in the economic growth or through Islam’s instruments of redistribution.

Pillar I. Institutional Framework

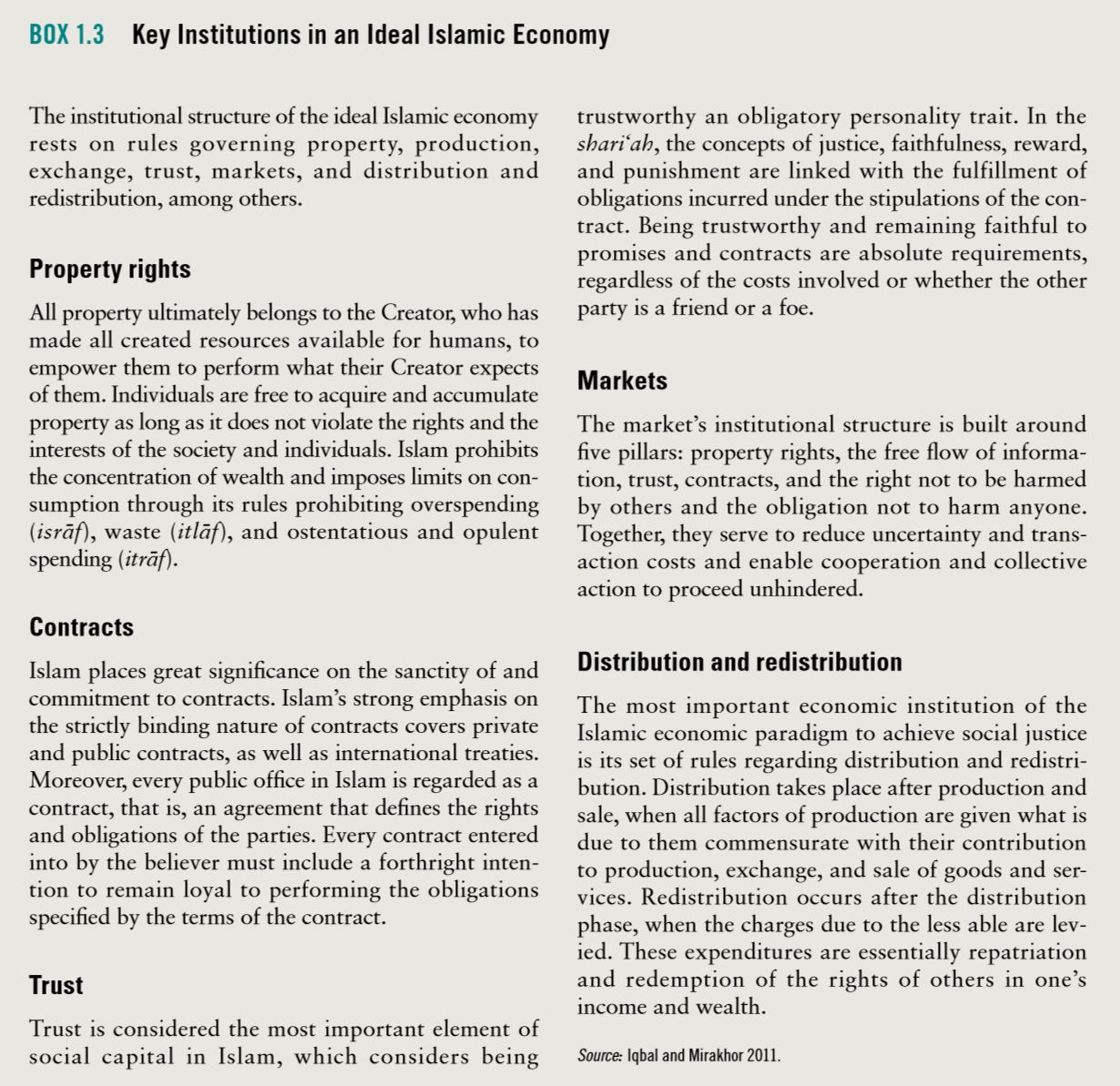

Establishing efficient institutions and an institutional framework in line with the principles of Islam—that emphasize universal values such as protecting life, preserving property rights and sanctity of contracts, building a more just society, protecting the rights of future generations, fostering mutuality and solidarity, and being sensitive to environmental issues—is essential in creating an enabling environment for the Islamic economic and financial systems to flourish. The institutional framework of the ideal economy consists of a collection of institutions: rules of conduct and their associated means of enforcement to deal with the allocation of resources, production, and exchange of goods and services and the distribution and redistribution of the resulting income and wealth.

The objective of these institutions is to achieve social justice. Each economic system has an “institutional matrix” that “defines the opportunity set … that makes the highest payoffs in an economy’s income distribution or … that provides the highest payoffs to productive activity” (North 2005, 61). Douglass North, in his 2005 book Understanding the Process of Economic Change, contends that in all economic systems, institutions (rules of behavior) are designed by humans to impose constraints on human interaction.

These institutions “structure human interaction by providing an incentive structure to guide human behavior. But an incentive structure requires a theory of the way the mind perceives the world and its functioning so that institutions can provide those incentives” (North 2005, 66). At this point, paradigms become relevant because paradigms in economics include conceptions of humankind and society and their interrelationships. An important function of the institutional framework is reducing uncertainty caused by lack of information, which can hinder decision making. Rules specify what kind of conduct is most appropriate in achieving just results, especially when individuals face alternative choices and must take action. Rules impose restrictions on what society’s members can do, without upsetting the social order upon which all members depend in choosing their own actions and forming their expectations of how others will respond and act.

Compliance with the rules makes people more certain in forming those expectations, prevents conflict, reconciles differences, coordinates actions, facilitates cooperation, promotes social integration and social solidarity, and strengthens the social order. In an ideal society, the degree of effectiveness in enforcing rules is determined by the degree to which the objective of achieving social justice becomes integral to members of the society.

Key Institutions of Islamic Finance

The Islamic economic paradigm is a Creator centered conceptualization of reality. Its view of the institutional framework is based on the following:

- Clear and secure property rights

- Contract enforcement

- Trust among people and between government and people, and among people and other institutions.

Such abiding trust can reduce risk, uncertainty, and ambiguity; strengthen social solidarity; bring private and public interests into closer harmony; and ensure coordination so risk can be shared better. One of the main advantages of having a well-established institutional framework is that it improves the flow of information and can reduce information asymmetries. The Islamic institutional framework has well defined rules and guidance on everyday life and economic transactions. Rules governing transactions—such as trustworthiness, truthfulness, faithfulness to the terms and conditions of contracts, transparency, and noninterference with the workings of the markets and the price mechanism so long as market participants are complying with the rules—provide a reasonably strong economy where information flows without hindrance. Participants can engage in transactions confidently, with minimal concern for uncertainty regarding the actions and reactions of other participants. Because of the high level of trust, transaction costs can be minimal. Due to the level of depth and clarity in these rules, if agents in an economy comply with them, the problem of information asymmetry would be minimized, which in turn would encourage Islamic financial instruments to function.

The Role of Public Policy

In all economic systems, the State plays a role in the economy. Only the extent of the State’s involvement differs, depending on the common values and belief system shared by the individuals that make up the particular society and the political structure that is in power during a particular period. The Islamic economy is to ensure that everyone has equal access to resources and means of livelihood, that markets are supervised so that justice is attained, that transfers take place from the more able to the less able, and that distributive justice is ensured for the next generation (Al-Hasani and Mirakhor 2003). The role of the government is only that of a trustee to society, and it is to act according to the rules prescribed in the Qur’ān and sunnah. The role of the government is broadly divided into two functions: a policy function that ensures that private interest does not diverge too far from public interest, and a function to design and implement an incentive structure to encourage rule compliance, coordination, and cooperation.

Islam uses the market as a mechanism to solve part of the coordination problem within the economy. The State enters the market as the supervisor/regulator of economic activity. It is the combination of State supervision/regulation and free enterprise that will be used to maximize social welfare. The State must actively complement market forces to ensure that individual initiative does not degenerate into a private greed for gains, especially when the gains are nonproductive. The symbiotic relationship of humankind, the Creator, and the environment can offer an alternative in achieving sustained and civilized development that could augment the proposed framework proposed by the World Bank Group.

Macroeconomic policies are taking cognizance of social and environmental elements as integral parts of the decision process (Mirakhor and Askari 2010). Hence there is a clear link between public policy based on Islamic principles and the emphasis on inclusive and environmentally friendly and fiscally sustainable development policies.

Islamic finance clearly states that the sole owner of all the property, including natural resources, is the Creator. Hence any abuse of natural resources, their wasteful or inefficient use, or disregard or negligence in creating externalities such as pollution is forbidden (Majah 1952). The Islamic perspective places a strong emphasis on intergenerational sustainability in both environmental and fiscal issues. In addition, Islamic public policies are required to pay a great deal of attention to inclusiveness and efficiency. Maqāṣid al-sharī‘ah principles direct the State to implement socially optimal and effective public policies that encourage cooperation rather than competition and support basic freedoms under which a market-oriented and socially inclusive economic system can flourish. Public policy to support financial integration with the real economy and to mobilize savings in developing countries could help promote risk mitigation and risk sharing, thus building resilience in the face of shocks.

Pillar II. Responsible Governance and Leadership

Governance can be regarded as the set of rules and norms that deals with the process and structures with which entities are managed, and that define the distribution of responsibilities between the management and related parties that are to gain or lose from the actions of the entity. The main objective of governance is to maximize the gains of the related parties and stakeholders within the social, legal, and market environment. The governance model in the Islamic economic system is a stakeholder-oriented model where the governance structure and process at the system and firm level protect the rights of stakeholders that are exposed to any risk as a result of a firm’s activities.

Whereas the conventional financial system is struggling to find convincing arguments to justify stakeholders’ participation in governance, a stakeholder model is built into Islam’s principles of property rights, commitment to explicit and implicit contractual agreements, and implementation of an effective incentive system. The design of the governance system in Islam can be best understood in light of principles governing the rights of the individual, society, and the State; the laws governing property ownership; and the framework of contracts.

Islam’s recognition and protection of rights is not limited to human beings but encompasses all forms of life as well as the environment. Each element of Allah (swt)’s creation has been endowed with certain rights, and each is obligated to respect and honor the rights of others (Iqbal and Mirakhor 2004). The principles of property rights and contracts in Islam offer theoretical foundations to acknowledge the rights of all stakeholders, Iqbal and Mirakhor (2004) argue. Islam’s principles of property rights, contracts, and a just social order define the business environment where economic agents are morally conscious of protecting property rights and contractual obligations to one another, whether acting as public servants, managers, employees, suppliers, or customers, or in any other capacity.

All participants in economic activities—whether individuals, firms, corporations, nonprofit organizations, or public institutions—are subject to the same degree of commitment. The notion of the sanctity of contractual obligations is not limited to explicit contracts, which are well defined, stipulated, and documented, but is equally applicable to implicit contracts, which are incomplete by nature. Property rights of all contractual parties—whether individuals, local communities, intangible legal entities, or the society— are preserved and protected.

A financial sector with weak governance and lack of transparency is bound to lead to debt financing, market frictions, inefficiencies, and financial exclusion. Strong corporate governance values would increase the accountability and transparency of the financial system. In Islam, the expected behavior of a firm is not any different from the expected behavior of any other member of the society. Although the entity itself does not have a conscience, the behavior of its managers becomes the behavior of the firm, and their actions are subject to the same high standards of moral and ethical commitment as expected from any member of society.

A firm’s economic and moral behavior is shaped by its managers acting on behalf of the owners, and it is their fiduciary duty to manage the firm for the benefit of all the stakeholders and not for the owners alone. Consequently, it will be incumbent upon managers and owners to ensure that the behavior of the firm conforms to the principles and the rules of Islamic law. les and the rules of Islamic law. Notions of responsibility and accountability play an important role in shaping the behavior of the leaders in the public and private sector. Business leaders are expected to act prudently as opposed to recklessly and to act with the best ethical behavior.

For example, taking excessive risks is a form of acting without prudence and probably in one’s own self-interest rather than the larger interest of the shareholders and stakeholders. Similarly, attempts to circumvent regulatory constraints,13 find loopholes in the law, and misrepresent matters, and acts of willful negligence that were common practice among top business leaders during the global financial crisis would not be the traits of a leader compliant with the rules of Islam.

Pillar III. Risk-Sharing Finance

The core principle of Islamic finance (Askari and others 2010) is risk sharing among the investors and the users of funds that stipulates that both share the outcome of the business or asset being financed —whether positive or negative.14 Unconditional prohibition of interest in any form by Islamic Law eliminates unsecured debt from the financial system. Instead, preference is given to asset-backed and equity or participatory finance, as well as financing of trading and exchange activities. Encouraging financial instruments that promote risk sharing and asset-backed financing could help deleverage financial systems (box 1.4) and make them more stable and resilient to economic shocks. The development of equity-based capital markets could play an important role in mobilizing resources without creating leverage in the economy.

A financial system based on asset-backed financing would encourage real transactions and growth in the real sector. A financial system based on risk-sharing principles would smooth out the boom-bust cycles in the economy, thus creating a more just and equitable society, because in such a system the distribution of profit and loss would be determined according to the risks each agent bears. Because counterparties would receive their fair share of proceeds in investments according to the risk they bear, the entrepreneurial spirit in a society would be invigorated.

Agents would be willing to take judicious risk in developing innovative ideas and actually bringing these ideas to life if they were rewarded according to the risk they would bear. A growing body of evidence demonstrates the significance of developing entrepreneurship in the economy through micro, small, or medium enterprises, which could serve as the engine for growth. Entrepreneurship encourages socially optimum risk sharing and promotes innovation. An economic system based fully on the principle of risk sharing mitigates the negative effects of recessions on certain investors while enabling the returns during high-growth episodes to be distributed in a more equitable manner.

Hence the risk-sharing principle not only can help create smoother business cycles but also can enhance a more sound and equitable pattern of income distribution in a society. Islamic finance, through its core principles, advocates for just and fair distribution of income and wealth during the production cycle and provides mechanisms for redistribution to address any imbalances that may occur. Islamic finance’s approach to redistribution is based on a balanced blend of income-based redistribution through redistributive instruments and asset-based redistribution through the notion of risk sharing.

Whereas the income-based redistribution approach offers only a partial solution—as it takes the current income distribution as given and aims at fairer distribution of future GDP—the asset-based redistribution is basically a risk-sharing approach and converges to Islamic finance’s contractual framework in terms of empowering equity participation by the lower-income groups in the society. Analytically, by making the poor direct holders of real assets in the real sector of the economy, the approach reduces their empirically observed high aversion to risk. It also creates positive incentives for promoting behavioral factors that enhance productivity (such as trust, truthfulness, and hard work) through the design of contracts that reduce or eliminate the difference between principles and agents and are conducive to achievement of the interests of all parties to a contract. Researchers suggest that good public policy and strengthened institutional frameworks in developing countries can go a long way toward reducing aggregate risk in an economy.

Policy improvements include strengthening governance to reduce damage to households due to excessive risk taking; achieving and sustaining economic and political stability; and promoting financial sector development. In terms of the institutional framework, clear and secure property rights, contract enforcement, and trust among people and between government and people and other institutions can reduce risk, uncertainty, and ambiguity; strengthen social solidarity; bring private and public interests into closer harmony; and ensure coordination to encourage risk sharing (North 2005; Mirakhor 2009; Mirakhor and Askari 2010). A system based on risk sharing has the potential of not only creating a smoother business cycle and a more equitable distribution of wealth but also speeding up the deleveraging of the financial system while encouraging the entrepreneurial spirit. Figure 1.4 illustrates how equity finance is more conducive to economic growth than other forms of financing.

Pillar IV. Financial and Social Inclusion

The main problems in enhancing financial inclusion are linked to risks arising from information asymmetries and the high transaction costs of processing, monitoring, and enforcing small loans. Information asymmetries can result from adverse selection (the inability of the lender to distinguish between high- and low-risk borrowers) or from moral hazard (the tendency for some borrowers to divert resources to projects that reduce their likelihood of being able to repay the loan, and the inability of the lender to detect and prevent such behavior).

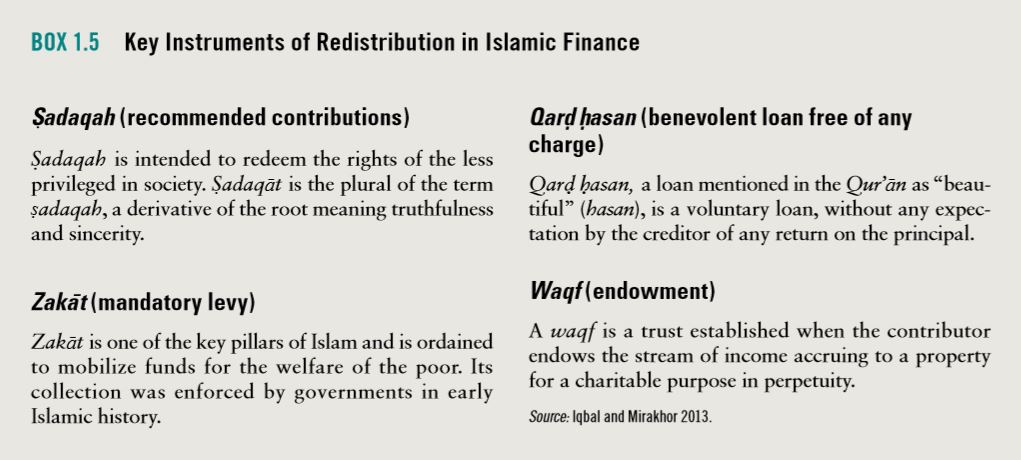

From an Islamic perspective, property is not a means of exclusion but of inclusion, in which to redeem the rights of those less able through the income and wealth of the more able. Islam emphasizes financial inclusion more explicitly than conventional finance; inclusion is embedded in core economic and social institutions of Islam.

Two distinct features of Islamic finance—the notions of risk sharing and redistribution of wealth—differentiate its path of development significantly from the conventional financial model.

The following are the main drivers of financial inclusion:

- Contracts of exchange and risk-sharing instruments in the financial sector

- Redistributive risk-sharing instruments that the economically more able segment of society uses to share the risks faced by the less able segment of the population (Askari, Iqbal, and Mirakhor 2015; Iqbal and Mirakhor 2011)

- Inheritance rules specified in the Qur’ān, through which the wealth of a person at the time of death is distributed among current and future generations of inheritors (Mirakhor and Iqbal 2012).

Instruments of redistribution are used to redeem the rights of the less able through the income and wealth of the more able. Rules of redistribution ensure that those unable to benefit by participating directly in production and consumption in the market, through a combination of their labor and their right of access to resources provided by the Supreme Creator for all humans, can redeem their rights through various redistributive mechanisms (see box 1.5).

Once these rights have been redeemed out of the income and wealth of the more economically able, the latter’s property rights on the remaining income and wealth are held inviolable. Contrary to common belief, these are not instruments of charity, altruism, or beneficence, but instruments of redemption of rights and repayment of obligations (Iqbal and Mirakhor 2013). The Qur’ān considers the more able as trustee-agents in using these resources on behalf of the less able. In this view, property is not a means of exclusion but inclusion, in which the rights of those less able are redeemed through the income and wealth of the more able. The result would be a balanced economy without extremes of wealth and poverty. The operational mechanism for redeeming the right of the less able in the income and wealth of the more able are the network of mandatory and voluntary payments such as zakāt (a 2.5 percent levy on asset-based wealth), khums (a 20 percent levy on income), and payments referred to as ṣadaqāt (recommended contributions). Finally, individuals who for some reason were left marginalized in the system without having the necessary resources to meet their basic needs are provided with the necessary social safety net through redistributive instruments.

Download Full Publication

![]() Islamic Finance – A Catalyst for Shared Prosperity (6.6MB)

Islamic Finance – A Catalyst for Shared Prosperity (6.6MB)

World Bank Group, and Islamic Development Bank

CC BY 3.0 IGO