Ireland has developed a strong foundation for the Islamic finance industry, including a comprehensive tax treaty network with Muslim nations and a provision in its tax code specifically for Islamic financial instruments, such as those involving ijarah (leasing), murabahah (sale on the basis of cost plus mark-up) and Islamic insurance (takaful).

Ireland is home to more than 50 world-class fund service providers, which are all supported by over 11,000 industry professionals, and it offers the widest range of expertise in fund domiciling and servicing. The industry managed assets worth more than €180 trillion in 2010. It is a significant location for Islamic funds, with an estimated 20% of the Islamic funds market outside of the Middle East being located in Ireland.

The Irish Government has supported the development of Islamic finance here. For example, the Irish Financial Regulator has set up a dedicated team to deal with the establishment of Shari’ah compliant investment funds.

A supportive tax and legal environment, easy access to the European market, a skilled workforce, an investor-friendly transfer pricing

regime, supportive infrastructure, business friendly policies and a stable regulatory environment make Ireland well positioned for

further development of Shari’ah-compliant business.

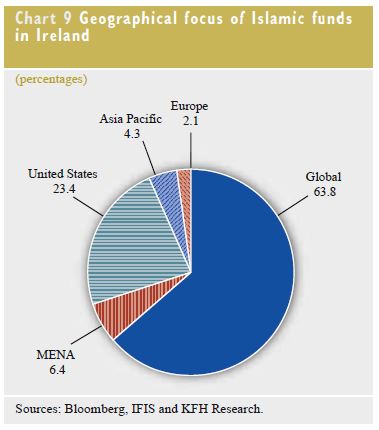

Of the total Islamic funds in Ireland, 63.8% have a global geographical focus; 23.4% the United States, 6.4% MENA, 4.3% Asia Pacific and 2.1%

Europe (see Chart).

As a leading centre for internationally distributed Undertakings for Collective Investment in Transferable Securities (UCITS) funds, Ireland

was one of the first countries to introduce the UCITS IV Directive into national legislation. UCITS established in Ireland can be traded throughout the 27 Member States of the EU.

Baljeet Kaur Grewal

European Central Bank