The UK has one of the most advanced Islamic financial markets in the western world and is quickly becoming a key destination for foreign Shari’ah-compliant institutions. The country is home to the west’s first fully fledged Shari’ah-compliant retail bank and currently has five true Islamic banks.

In 2014, the United Kingdom became the first Western European country to issue a Sovereign Sukuk with a 5 year dated £200M issuance. According to data published by Al Rayan Bank, as end of 2014, the UK was the world’s ninth largest market, the leading Western country and Europe’s premier centre of Islamic finance with $19bn of reported Sharia compliant assets. There are more than 20 international banks operating in the UK are working in Islamic finance, 6 of which are fully Sharia compliant. The UK has the largest legal services market in Europe and around 25 major law firms with offices in the UK are supplying Islamic legal services.

London in particular is an important financial centre, with major international firms and the Middle East’s biggest traditional banks offering Islamic products in this city. Islamic financing activities started in the UK in the 1980s when the London Metal Exchange provided Shari’ah-compliant overnight deposit facilities based on the murabahah principle.

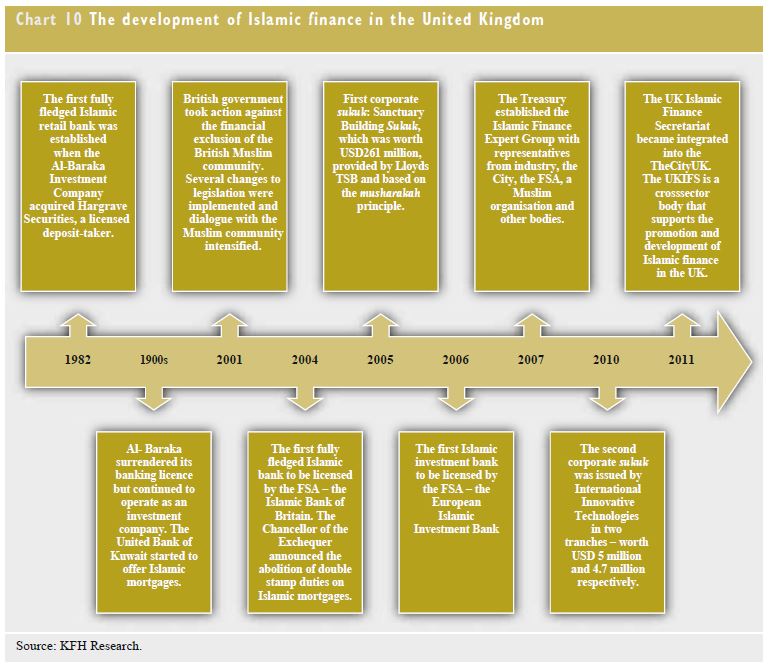

In 2005, the Sanctuary Building Sukuk was launched; the first corporate sukuk in Europe and the first from the UK. Based on the same structure, the second corporate sukuk was issued by International Innovative Technologies (IIT) Ltd in 2010. The British government undertook a consultation on the legislative framework for alternative finance investment bonds or sukuk that are structured to have similar economic characteristics to conventional debt instruments. Following the consultation, the government introduced measures clarifying the regulatory treatment of corporate sukuk, which reduced the legal costs for this type of investment and removed unnecessary obstacles to their issuance. In March 2013, the UK Government established a first Islamic Finance Task Force.

The UK is a major global provider of the specialist legal expertise required for Islamic finance, with around 25 major law firms providing legal services in this area. Specialist services are also available for advice on tax, listings, transactions, regulations, compliance, management, operations and information technology systems.

Islamic banking began in the UK in the 1990s when corporations from the GCC introduced Islamic mortgages (based on the murabahah principle) and offered mortgage financing (based on the ijarah principle) shortly thereafter. However, these instruments were perceived to be very expensive due to the double stamp duty applicable (i.e. first, when a bank purchases a house, and, second, when a buyer/client purchases this house from the bank concerned). The abolition of the double taxation regime in 2004 paved the way for increased demand for Islamic home financing.

The Bank of England and the Financial Services Authority (FSA), the two banking regulators, have been open to the development of Islamic finance in the UK. The Islamic finance sector operates under a single piece of legislation that applies to all sectors, namely the Financial Services and Markets Act 2000. Hence, there is a level playing field for Islamic and conventional financial products; allowing the market to cater to the needs of ethnic minority consumers.

The UK government’s enabling fiscal and regulatory framework for Islamic finance includes the following (see Chart 10):

• the abolishment of capital gains tax and stamp duty (land tax) for sukuk issuances and Shari’ahcompliant home mortgages;

• the reform of arrangements for bond issues so that returns and income payments are treated in a similar manner to interest;

• FSA initiatives to ensure that the regulatory treatment of Islamic finance is consistent with its statutory objectives and principles.

Baljeet Kaur Grewal, European Central Bank

Al Rayan Bank, UK