Whilst Islamic Finance is often branded as Ethical Finance and therefore as a by-product attempting to appeal to a wider audience irrespective of religious beliefs, the reality is Muslims represent the biggest consumers of Islamic Finance.

The Muslim population of the world is estimated at 1.5 billion, representing 24% of total world population of 6.3 billion. It is too simplistic to assume all Muslims require Islamic Finance services, many are too young or too poor to be able to engage with the sector, whilst many do not have concerns about the use of interest in conventional banking.

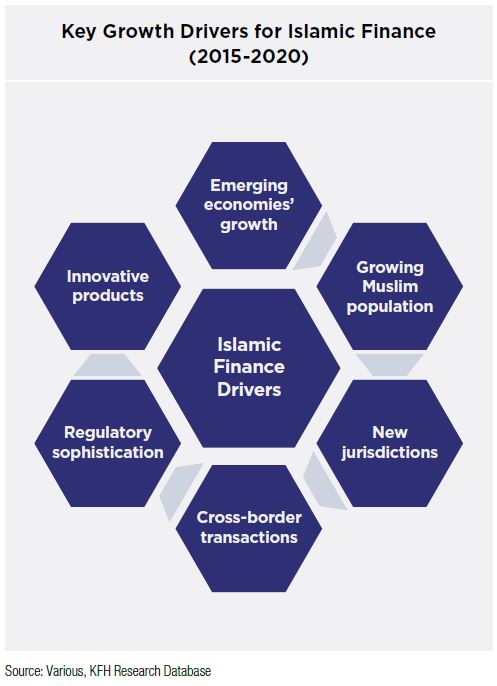

Islamic finance remains supported by structural and demographic factors, as well as the generally better economic sentiment in emerging economies. Next year, the industry’s total assets is expected to increase to USD2.4bln and to expand further to above USD4bln by 2020 (CAGR 2014- 2020: 12.5%). Growth will be spurred mainly by the leading domiciles of Malaysia, Saudi Arabia, the UAE, Qatar and Kuwait; new frontiers such as Indonesia and Turkey; as well as the expected entry into nascent markets in Africa and Central Asia. In these countries, retail and corporate financing are likely to be the main sources of business for Islamic finance, driven by private consumption and investment.

Source: Malaysia International Islamic Financial Centre (MIFC)