Global gross takaful contributions are estimated to have amounted to USD26bln as at end-2014. Saudi Arabia and Malaysia are the largest takaful markets by gross contributions. Saudi Arabia generated an estimated USD7.2bln in gross takaful contributions in 2014, while Malaysia gathered about USD2.7bln.

Developments in takaful are likely to accelerate in key domiciles such as the key GCC countries and Malaysia, as well as highly populated Muslim countries where takaful is gaining popularity such as Indonesia and Pakistan. In Pakistan, for example, a recent change to regulations will now allow conventional players to establish takaful windows, which should spur greater competition and innovation in the jurisdiction’s nascent takaful market. Meanwhile, new entrants to the takaful market are likely to orginate from African countries (Kenya, South Africa, Morocco, Nigeria) and Asia (Afghanistan, Kazakhstan, Thailand, Sri Lanka); these countries are currently either at exploration stage or have a handful of takaful players in the market. Total gross takaful contributions are expected increase to around USD26bln at end-2015 and USD42bln by 2020 (2014E: USD23bln)

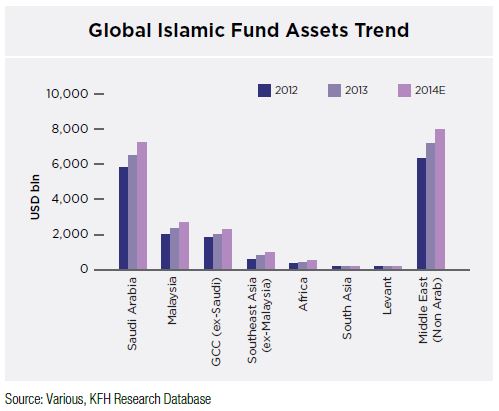

Notably, even the key takaful markets have relatively low rates of takaful and insurance penetration, suggesting ample room for growth. In Saudi Arabia, the newly enforced 2012 Mortgage Law is expected to boost demand for home financing and thus, support growth of housing-related protection products such as Coverage for building materials and fixtures and fire risk; as well as life takaful. In other GCC markets such as the UAE and Qatar, takaful operators may leverage on recent legislations mandating health insurance for the population. Meanwhile, the Malaysian takaful market could undergo changes in operating flexibility, product disclosure and delivery channels to market practices, as mentioned in the concept paper for BNM’s Life Insurance and Family Takaful for Everyone (LIFE) framework Generally, the four main Islamic finance segments – Islamic banking, sukuk, funds and takaful – are expected to grow further, albeit at more moderate rates compared to the recent surge.

These growth rates reflect a more sustainable path for the industry, especially in key jurisdictions where regulatory enhancements are expected to improve the quality of Islamic financial products and services; improve the resilience of the industry to external shocks, and; support consumer confidence in the industry. Overall, these developments are positive for the Islamic finance sector in the longer-term, as a provider of competitive and safe financial services to the economy.