GCC Credit Market Update

Article Overview

In its monthly update, Kuwait based Rasameel provides recent updates as the Sukuk market displayed signs of increased activity. Sukuk represent $288 Billion of the wider $1.66 Trillion Islamic finance market.

Recent Sukuk Issuances

Details of recent Sukuk issuances by Governments of Malaysia, and Central Bank of Turkey.

Report Coverage

Market commentary

- Abu Dhabi’s NPCC eight year AED2.2m loan

- Saudi Aramco seeking USD10bn RCF

- Emirates Airlines hiring banks for sukuk issuance of USD1bn

- NBAD successfully issuing a 5 year USD750m bond

- Credit growth in Kuwait rising to 6.2% year on year

- Qatar’s money supply back on track in Q4 2014

- Oil price decline to tighten bank liquidity

- Qatari Banking sector loan book contracted in January 2015

- QIIB seeks approval for sukuk issuance

- S&P: UAE banks profit growth to dip in 2015

- Saudi Arabia private sector credit grew by 12.6% annually

- ENOC, QNB and Meraas sign loan derals

- FGB issues a dollar denominated sukuk

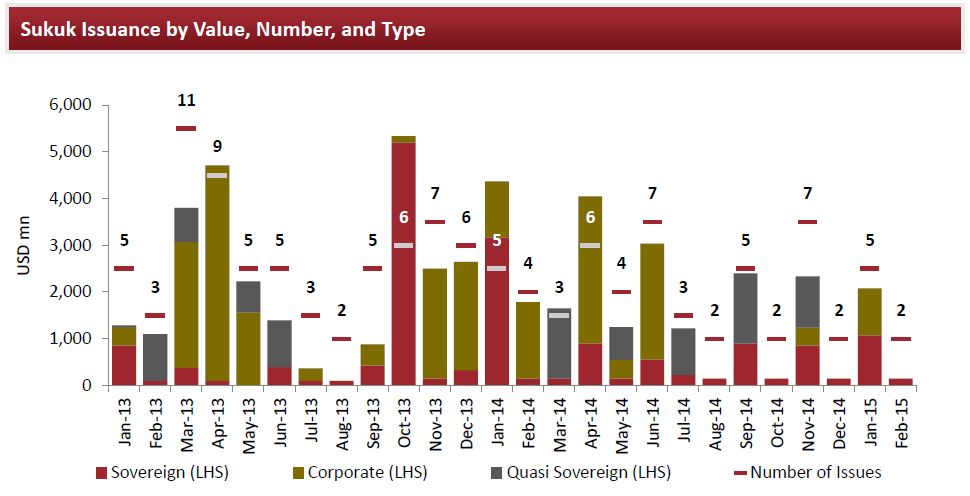

Sukuk issuances by volume declined significantly in the month of February 2015, down by 92% y-o-y and 93% m-o-m to USD0.1bn. There were only two short term sovereign issuances from the Central bank of Bahrain. Sovereign comprised 55% of the total issuance volume for YTD February 2015(USD2.2bn),followed by corporate at 45% and there have been no quasi-sovereign issuances in 2015.

Download Report

Download Full Report: ![]() GCC Market Update February 2015 (810KB)

GCC Market Update February 2015 (810KB)