![]()

Commentary by RHB Global Sukuk Markets Research, Kuala Lumpur, Malaysia

Global Sukuk Markets Weekly

Article Overview

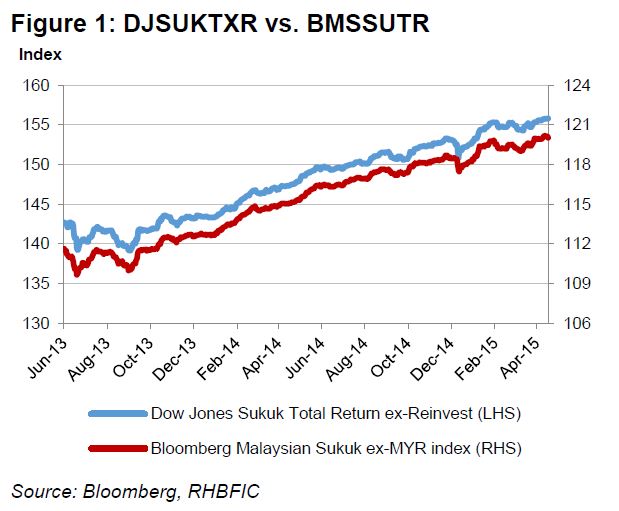

Market unperturbed by selling in US Treasuries. Global sukuk yield (weighted by amount outstanding) under our coverage tightened 1.8bps to 2.861% (average duration: 4.321y) during the week, led by DPWDU 17, DAMACR 19 and MALAYS 15. The Bloomberg Sukuk Market Return Index (BMSSUTR) inched up 0.06% W-o-W (vs. -0.08% in week prior) to 119.90, bringing YTD returns to 1.44% (vs. 1.38% in week prior). Whereas, the Dow Jones Sukuk Total Return Index (DJSUKTXR) declined 0.08% W-o-W (vs. -0.12% in week prior) to 155.18, bringing YTD returns to 1.76% (vs. 1.84% in week prior).

Modest improvements in jobs data (i.e. NFP, unemployment rate and initial jobless claims) left investors anxious over timing of the first Fed hike resulting in a UST curve steepener over the week. Meanwhile, risk sentiments eased in EU with Greek’s repayment to IMF and the Conservatives winning the UK elections. The top 5 gainers in the BMSSUTR during the week were SECO 17, SIB 18, QIIK 17, ISDB 16 and TAMWEE 17 bringing a total market value gain of USD3.6bn.

Macroeconomic and Sovereign Comments

Hong Kong (Aa1/AAA/AA+; Sta)

Announces USD1bn 5y sukuk, having the same tenor and size as its debut sukuk which pulled in 4.7 times (x) bid-to-cover (BTC) in September 2014. Moody’s assigns (P)Aa1 to the sukuk issued by Hong Kong Sukuk 2015 Ltd, the special purpose vehicle (SPV) established by the Hong Government sukuk. Proceeds to be directed for no less than 34% of the lease assets (a Wakalah portfolio managed by the Hong Kong government), and the remaining can hold not more than 66% to enter into a commodity murabahah (CM) arrangement.

RHBFIC View

Positive. Given the strong demand for the Malaysia USD sukuk (c. 5-6x BTC), this issuance should be well received. The first Hong Kong issuance that was issued in September last year was priced at 2.005% (c.23 bps above 5y USTs), and we believe that pricing could be tighter given the indication in previous sukuk issuances this year so far. The GBHK ((P)Aa1/AAA/NR) (YTM: 1.85%; z-spread: 35.69bps) yield was relatively unchanged during the week (-4bps W-o-W).