Bonds Beat Sukuk in GCC for May

Article Overview

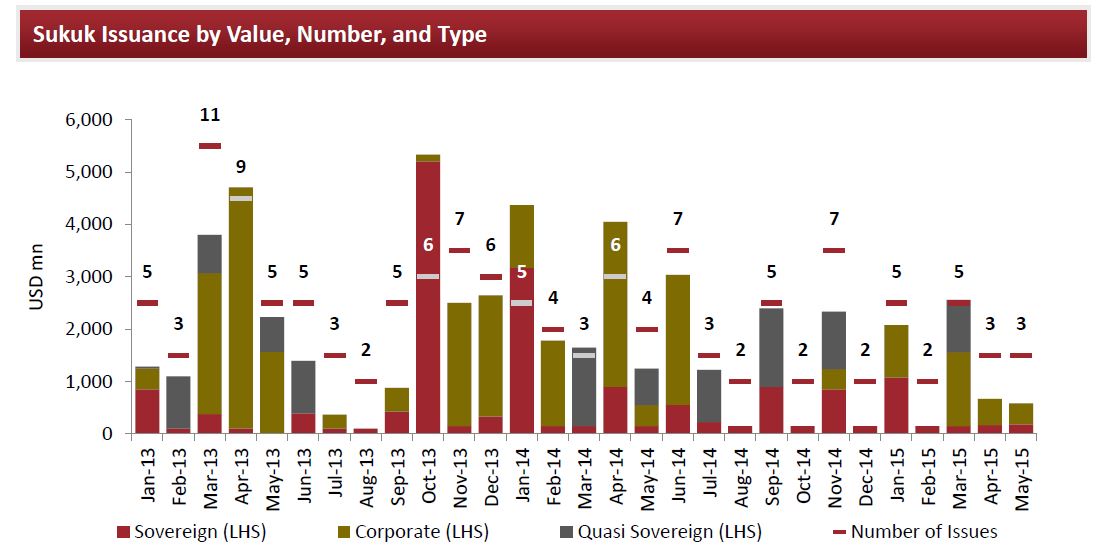

Sukuk issuances in the GCC for May 2015 declined in terms of both value and number; by value decreased 53% y-o-y to USD0.6bn.

For YTD May 2015 sukuk issuance by value declined 46% y-o-y to USD7.0bn, mainly driven by a sharp decline in sovereign issuances (-40% y-o-y), corporate (-48%y-o y) and quasi sovereign issuances (-55%y-o-y). Corporates comprised 47% of the total issuance value for YTD May 2015, followed by sovereign at 39% and quasi-sovereign issuances at 14%.

Bond issuances by value rose 8% y-o-y for May 2015, with 10 issuances totalling USD3.4bn. For YTD May 2015 total bond issuances by value increased 13% y-o-y to USD13.5bn.

Outside GCC Sukuk Market Remained Busy

The data was compiled by by Kuwaiti Investment Bank, Rasameel and covers GCC data only. Outside of the GCC the sukuk market remained busy with issuances from Hong Kong, Pakistan’s K-Electric and Indonesia’s Nation Carrier Garuda.