![]()

Report by Malaysia International Financial Centre Report

Offshore Financial Centres – Attractive for Islamic Finance

Article Overview

As the Islamic financial industry continues to experience exponential growth, offshore financial centres (OFCs) are keen to market their value for the development of Islamic financial products. OFCs are working towards establishing comprehensive eco-systems to gain competitive advantages over other jurisdictions for Islamic finance. Most OFCs promote the element of low taxes or low costs of doing business to attract international Islamic finance businesses.

The global Islamic financial industry has expanded rapidly in the past few years, with assets growing at a double-digit compound annual growth rate (CAGR) of 17% between 2009 and 2013. As of 1H2014, the Islamic financial industry’s assets were estimated at USD1.87tln. As Islamic finance industry continued to experience exponential growth, various possibilities are being sought after by investors and Islamic finance service providers for investments and structuring of Shariah compliant products.

Low Tax and Low Costs

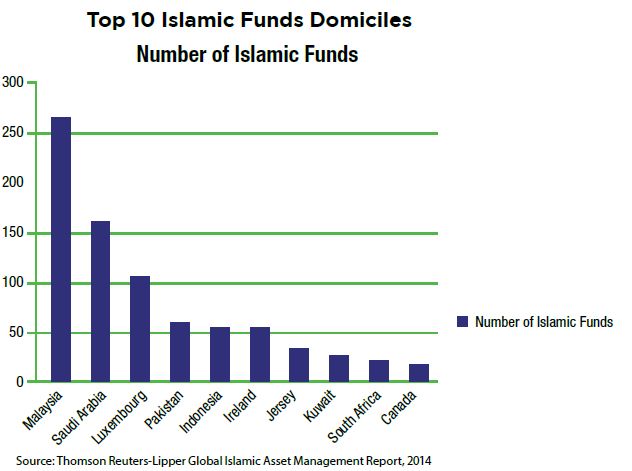

One such possibility is the offshore financial centres (OFCs). On the other hand, OFCs are also keen to market their value to the development of the new wave of Islamic financial products. Commonly, OFCs are jurisdictions with small domestic economies – such as the British Virgin Islands (BVI), Cayman Islands, Bermuda, Luxembourg and Jersey, among others. They are established to attract foreign financial capital through numerous incentives, including low taxes, political stability, business-friendly laws and regulations, banking secrecy and anonymity. Accordingly, along with conventional transactions, many of these OFCs are now introducing additional facilities to further lure the growing Islamic businesses.

Download Report

![]() Offshore Financial Centres – Attractive for Islamic Finance (900KB)

Offshore Financial Centres – Attractive for Islamic Finance (900KB)