Report by Malaysia International Financial Centre Report

Islamic Finance: Prospects and Challenges

Article Overview

In just four decades, the Sharia compliant finance industry has grown from a niche banking system to be regarded as one of the fastest growing segments of the global financial industry, with total global financial assets estimated to be around USD2tln. The past five years have been most significant, recording 17.3% Compounded Annual Growth Rate spurred by improved industry infrastructure, a more comprehensive industry, broader investor and issuer base and consequently, with more cross-border transactions. Adding further to its global status, Islamic Finance has attracted the attention of advanced economies to tap into this growing market; testament to its universal appeal and propositions.

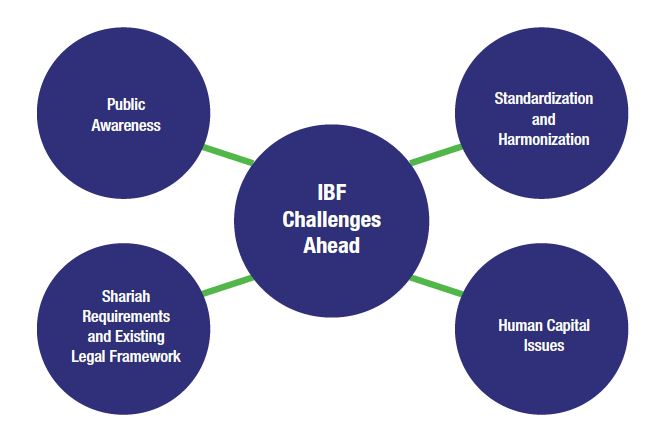

Challenges Ahead

Human Capital Issues

Highly dedicated and qualified human resources undoubtedly play a vital role for the development and success of any organization. In this regard, the Islamic financial industry requires a specific set of competencies and skills, such as Shariah understanding and market insight.

Standardization and Harmonization

Given the nature of Islamic law which accommodates for different interpretations, Islamic finance is subject to different interpretations which lead to different practice and use of concepts across jurisdiction. This may impede the growth and internationalization of Islamic finance since certain products may not be accepted in some jurisdictions but not in the other.

Shariah Requirements and Existing Legal Framework

Islamic finance is established based on Shariah principles thus the existing legal and regulatory framework should take into consideration the value propositions promulgated by Shariah.

Public Awareness

The low penetration rate of Islamic financial industry in certain jurisdictions is mainly due to lack of public awareness and perception toward Islamic financial

products and services.