Indonesia and Jordan Local Currency and Dollar Sovereign Issuances Expected

Article Overview

Sukuk supply is picking up after recent sovereign announcements by Jordan and Indonesia, as well as a slew of announcements from Malaysian and Turkish corporates and the AAA rated Supranational International Finance Corp, part of the World Bank.

Jordan expects to issue a debut sukuk in the coming weeks for value of JOD150 million (US$210.76 million), and may issue a second sukuk before the end of year.

Indonesia stated this week it intends to issue a US dollar sukuk in 2016 of up to $850 million, whilst next week will issue in its local currency as part of its regular domestic programme a IDR2.5 trillion (US$174.5 million) sukuk. Noor Bank (formerly Noor Islamic Bank), a UAE bank ran in accordance with Sharia principles has been hired by the Indonesian government to arrange the US dollar sukuk. In 2016 some 13.7 trillion rupiah (S$1.37 billion) of sovereign sukuk tied to ventures will be offered, up from 7.14 trillion in 2015, Finance Minister Bambang Brodjonegoro said Aug 25.

In an interview with Bloomberg, Ezra Nazula, head of fixed income at PT Manulife Aset Management Indonesia said demand for the sukuk may be stronger than for non-Islamic notes because sukuk usually offer a yield advantage. “Investors in project-based sukuk tend to be local investors seeking more stability than the conventional bonds,” he said. Indonesian sukuk “gives us an attractive spread over conventional bonds with relatively identical risk,” he added.

World Bank International Finance Corp Returns to Market

The Aaa/AAA rated supranational International Finance Corp (IFC), the World Bank’s lender to the private sector will likely issue in the coming days after meeting with potential investors last week. This would be the third time the World Bank’s development division issues sukuk after a 500 million Malaysian ringgit three-year issuance in 2004, and a $100 million five-year issuance in 2009. Dubai Islamic Bank, HSBC, National Bank of Abu Dhabi and Standard Chartered Bank are the arrangers.

Corporate Sukuk Activity

Saudi Arabia’s Al Othaim Real Estate and Investment Co raised 1 billion riyals through a debut sukuk issue in the past week. Full details of this and other Sukuk can be found in the Sukuk.com Sukuk Database.

Turkish Sharia compliant lenders Turkiye Finans Katilim Bankasi and Albaraka Turk have both signalled intentions to issue domestic rental certificates (sukuk). Turkiye Finans intends to raise up to 1.5 billion lira through its wholly-owned unit, TF Varlik Kiralama, whilst Albaraka Turk, stated it aims raise up to 1 billion lira through its asset-leasing company, Bereket Varlik Kiralama.

In Malaysia Electric utility company Tenaga Nasional (TNB) stated it will issue sukuk to raise up to RM10 billion through its subsidiary Jimah East Power (JEP). TNB said the 23-year sukuk would be issued in one lump sum with a 23-year tenor. CIMB Investment Bank Bhd, HSBC Amanah Malaysia Bhd and Maybank Investment Bank Bhd are managing TNB’s sukuk issue. No date for the issuance was given.

Sukuk Volumes Down but Market Breadth Increases

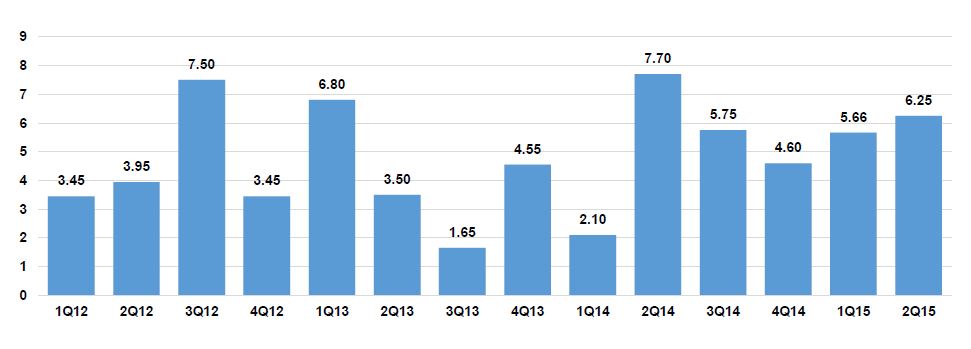

The Sukuk record for issuances was in 2012 when $137.1 billion was raised, while issuance dropped to $116.9 billion in 2013 and fell further in 2014. Issued sukuk which have yet to mature are valued at around $300 billion, representing the second largest asset sector of the wider Islamic finance market after Islamic Banking which accounts for approximately $1.6 Trillion in assets.

Jordan joins a number of Sovereigns including South Africa, Hong Kong and the United Kingdom who have issued debut sukuk with the aim of spurring further domestic issuances by corporates.