Report by Malaysia International Financial Centre Report

Contribution of Islamic Finance to Real Economic Development

Article Overview

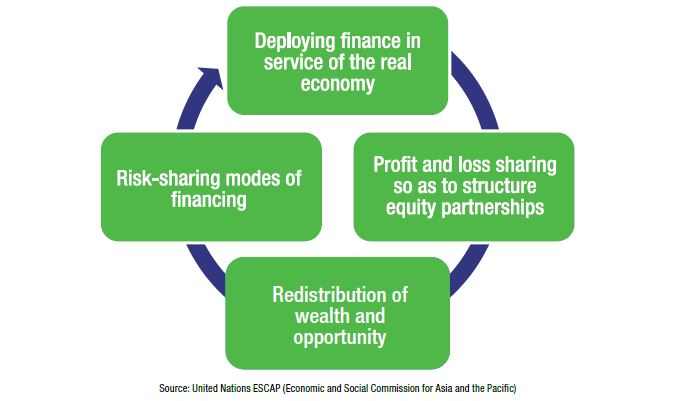

While overall economic growth in 2015 remains moderate, with uneven prospects across the main countries and regions, pockets of economic activities continued to expand in key real sectors such as infrastructure (including transportation, power and utilities and telecommunications). Comparative to last year, the prospects for advanced economies are improving, while growth in emerging market and developing economies is projected to be lower, reflecting weaker outlook for some large emerging market economies and key Islamic finance oil-exporting countries. However, important processes which contribute to real economic development such as sovereign funding, financing of business and household transactions remained an important areas for Islamic finance to serve. Key Islamic finance segments such as Islamic banking and capital markets continued to support economic growth across the globe by providing Shariah-compliant modes of funding and financing. It is noteworthy to inform that Islamic finance not only offers an alternative source of financing for real economic development but also has inherent characteristics and principles that lend themselves well to catalyzing and promoting real economic development.