Report by Malaysia International Islamic Financial Centre

Role of Islamic Finance in Bridging the Funding Gaps of SMEs and MSMEs

Article Overview

Socio-economic justice which is one of the main features present in the Islamic financial system is critical in achieving financial inclusion. Financial inclusion helps to address slow investment growth, weak productivity and income inequality, exemplified by the present-day modest economic growth. The contribution of Islamic finance towards socio-economic justice among others include the availability of socio-economic tools that could help to improve financial access and foster the inclusion of those deprived of financial services to achieve real economic growth.

Various socio-economic tools that Islamic finance can further tap into include zakat, waqf and qard al-hassan (benevolent loan) alongside socio-economic financial instruments that are designed to provide financial assistance to the poor such as shariah-compliant small and medium enterprises (SMEs) and micro small and medium enterprises (MSMEs).

Islamic Finance: A Catalyst for Inclusive Growth

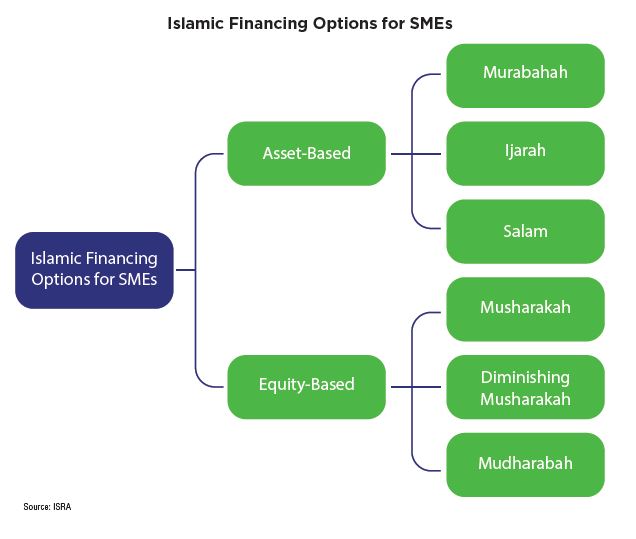

The foundational philosophy of Islamic finance relies heavily on the economic and social development factor, including financial inclusion in the form of servicing the un-bankable of the society, such as some of the SMEs and MSMEs. Financial inclusion can be addressed in Islamic finance by promoting asset-based and equity-based contracts as a viable alternative to conventional financing. Of more importance, Islamic finance risk-sharing features and the strong link of credit to collateral that is well suited for SMEs and MSMEs are known to promote inclusive growth.

Therefore through a portfolio of asset-based and equity-based financing solutions for SMEs and MSMEs in Islamic finance, a clear financing gap for this sector can be tackled.18 This is because through asset-based financing, it fulfils essential requirement of Islamic financial transaction by ensuring that the financial transaction is part of a real economic activity with a close financial linkage to the financial assets. On the other hand, equity-based financing exercises profit and loss sharing between financiers and entrepreneurs which promotes the alignment of their interests, increases risk-sharing, and foster entrepreneurship mainly at the early stage start-ups which rely purely on equity financing for their ventures.

Download Full Report

![]() Islamic Finance – Bridging the Funding Gaps of SMEs and MSMES

Islamic Finance – Bridging the Funding Gaps of SMEs and MSMES