Growth Trajectory in Islamic Finance Remains Strong

Article Overview

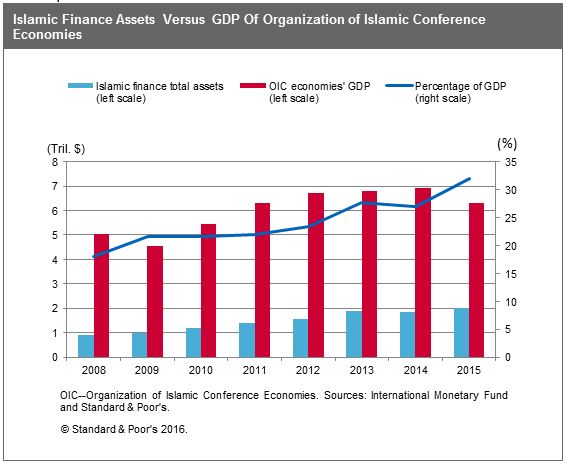

In a report released this week, Standard and Poor’s estimated Islamic finance assets in Organisation of Islamic Conference (OIC) countries to be about $2.1 trillion by the end of 2015. Cumulative GDP for the same OIC countries stood at more than $7 trillion.

Whilst the majority of specifically designed Islamic compliant assets are located in OIC countries, a significant amount reside in non-OIC locations, particularly in Europe where Luxembourg and the United Kingdom lead in Islamic Asset Management and Capital markets respectively. Furthermore, jurisdictions such as Hong Kong and South Africa, as well as the United States through institutions such as the World Bank have been active in issuing Sukuk.

Taken as whole it is likely Islamic compliant financial assets exceed $2.5 trillion, and may push pass the $12 trillion mark as Saudi Arabia seeks to IPO a number of Islamic compliant equities.

Islamic Finance Assets in OIC Countries at end of 2015 – Source: Standard and Poor’s

Sukuk Market Growth – Year on Year

Fitch Rating, in its report this week stated the proportion of sukuk issuance’s hit a record in Q1 2016 in the main markets. Citing the increase in compliant legal frameworks to allow such issuances, Fitch stated new sukuk issuances in GCC, Malaysia, Indonesia, Turkey, Pakistan and Singapore was around USD$11.1 billion, a 21% year on year increase. Sukuk represented 39.3% of total bond and sukuk issuances in these countries during Q1 2016.