International Islamic Financial Market (IIFM) Sukuk Report, 5th Edition

Article Overview

Data from International Islamic Financial Market (IIFM) Sukuk Report, 5th Edition published March 2016

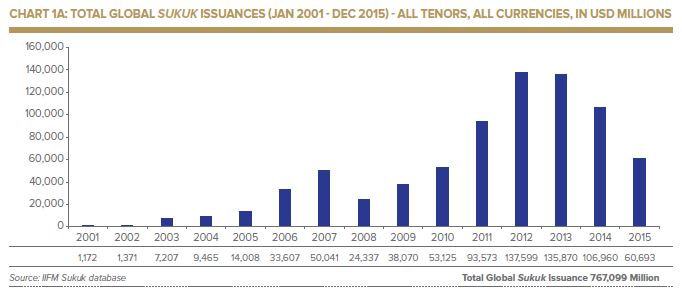

2012 and 2013 were record years for global Sukuk issuances while in 2014 the Sukuk market slowed down to just over USD100 billion issuances. 2015 witnessed a major drop in issuances when only USD60.6 billion Sukuk were issued, a massive 43% fall compared to 2014. However, a large part of this decline is due to BNM policy decision to discontinue issuance of short-term investment Sukuk and this may not be taken as a reflection of weakness in the Sukuk market but a change of strategy.

If BNM had continued its short term domestic Sukuk issuance as in 2014, then 2015 Sukuk issuances would have been around USD100 billion. Although there is a drop in short term Sukuk market due to BNM decision; however, the entry of other issuers such as power producing companies, project financing entities, corporates, quasi-sovereign as well as entry of several new jurisdictions and re-issuances by sovereign issuers have kept the Sukuk market active.

The Malaysian Short Term Ringgit denominated Sukuk although, have dropped considerably; however, it is interesting to note that Malaysian global sovereign & quasi-sovereign issuances of over one year tenor have actually increased from USD8.1 billion in 2014 to USD14.3 billion in 2015. As far as Malaysian corporate sector issuances are concerned there were 238 corporate issuances amounting to USD11.57bio in 2015 as against 211 issuances amounting to USD9.96bio in 2014.

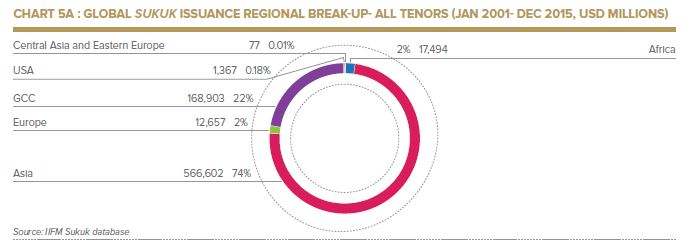

Asia continues to be the dominant player in the global Sukuk market. In terms of region, Asia accounts for 74% of global Sukuk issuances since inception of the market. The regional shares are depicted in chart 5A below. GCC is the second largest destination of Sukuk, however at 22% of global Sukuk issuance, it’s a long way from Asia’s share of the total market.

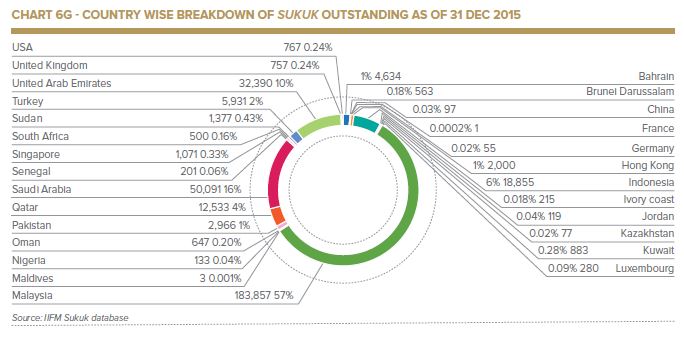

Of the total volume of Global Sukuk outstanding from a country perspective, 93% is represented by just 5 countries , Malaysia 57% , Saudi Arabia 17% , UAE 10% , Indonesia 6% & Qatar 4%. Right behind them are Turkey 2% , Bahrain Hong Kong with 1% each.

Download full Report

![]() IIFM Sukuk Report (5th Edition) A Comprehensive study of the Global Sukuk Market (12.2MB)

IIFM Sukuk Report (5th Edition) A Comprehensive study of the Global Sukuk Market (12.2MB)