The Malaysia based Islamic Financial Services Board (IFSB) has published its 2016 report.

Decline in Sukuk, Takaful & Islamic Banking Assets Grow

Article Overview

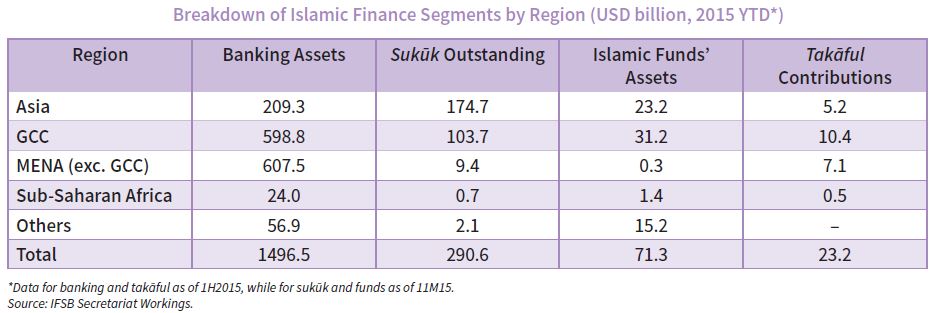

In comparison to the 2015 IFSB Stability Report, the global Sukuk outstanding, based on par value at issuance, declined in 2015 by 1.4% to USD290.6 billion.

In contrast, the Takaful sector grew by 8.4% to USD23.2 billion, while the Islamic banking sector assets grew at 1.4% to USD1.5 trillion.

Despite the modest growth of the banking sector, the cumulative growth rate has led to an increase in its systemic importance, with the number of countries that have more than 15% of banking sector assets in Islamic banking rising to 11.

Size of Islamic Financial Market 2016

The global Islamic financial services industry reached an overall total value of USD1.88 trillion as of 2015 YTD. In comparison to values reported in the previous IFSB Islamic Financial Services Industry (IFSI) Stability Report 2015, by sector, the global sukuk outstanding (based on par value at issuance) has declined by 1.4% to USD290.6 billion (FSR2015: USD294.7 billion), while Islamic funds’ assets have contracted by 6.3% to USD71.3 billion (FSR2015: USD75.8 billion). In contrast, the takaful sector is estimated to have expanded by 8.4% to USD23.2 billion FSR2015: USD21.4 billion), while the dominant Islamic banking sector has grown moderately at 1.4% to USD1.5 trillion (FSR2015: USD1.48 trillion).

Other Areas of Discussion

The remainder of the report takes a look at the resilience of the Islamic financial system covering Islamic Banking, Takaful and the Islamic Capital markets. The final chapter examines emerging issues in Islamic Finance including anti money laundering and combating the financing of terrorism, as well as asserting regulatory consistency in the implementation of global prudential standards.

Download Report

![]() IFSB Stability Report 2016 (13MB)

IFSB Stability Report 2016 (13MB)