VTB Capital has helped arrange a $500 million sukuk for UAE based property developer Damac (NR/BB/NR). The sukuk issued in the name of Alpha Star Holding III Limited drew demand of around $1 billion and was priced at a profit rate of 6.25%. The issuance came in tighter than its initial price guidance of 6.5% and will be used to repay Damac’s USD650m sukuk due in 2019.

Primary Sukuk Market

Article Overview

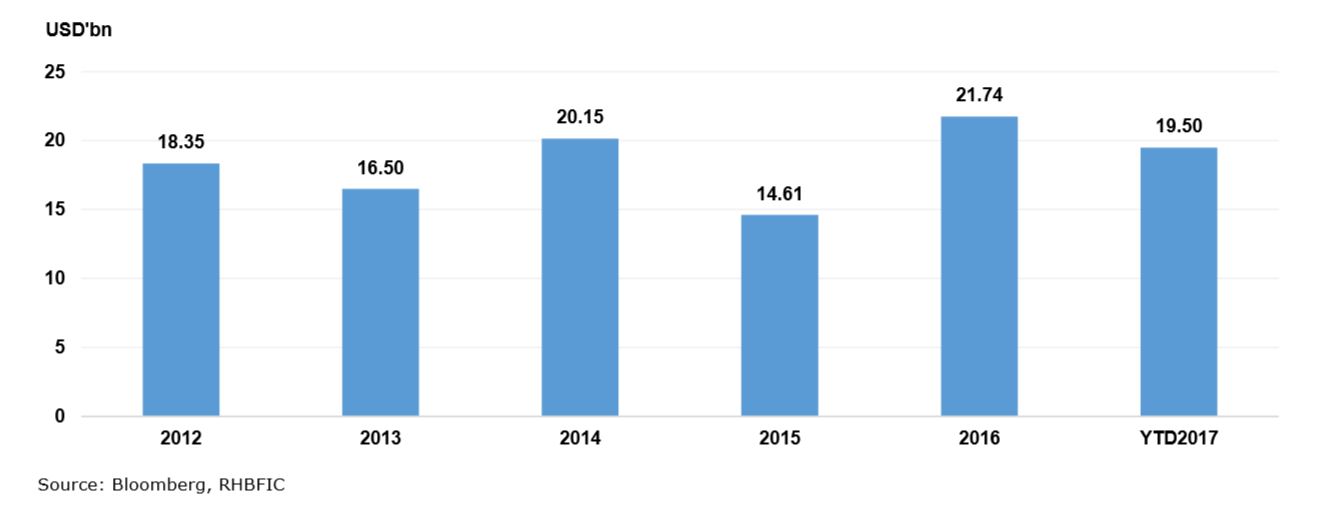

The primary sukuk market is likely to surpass the USD23bn mark set in 2017 after Saudi Arabia’s USD9bn issue. The Kingdom (A1/A-u/A+) issued two tranches totalling USD9bn. Its 5y KSA ‘22 was priced at MS+100bps and KSA ‘27 priced at MS+140bps, with both names together pulling in over 3.7x bid to cover.

Malaysian Sukuk Market

The new 5y GII benchmark attracted good BTC of 2.77x at average yield of 3.948%, with a relatively strong demand compared to the average 1.8x BTC for the previous 4 auctions. On regulation, BNM announced 13-Apr the possible introduction of shorting for GII and additional hedging flexibility for investors in relation to FX hedging while streamlining processes, effective 2-May. The MYR strengthened against USD during the week to 4.4115 (0.72% WoW) as global oil prices strengthen.

Partial Source: RHB Global Sukuk Markets Research, Kuala Lumpur, Malaysia

![]()