London Sukuk Summit at London Stock Exchange with Islamic Development Bank

Article Overview

5 March 2018 – Leading luminaries from Islamic finance gathered at the London Stock Exchange for an Islamic Development Bank organised Sukuk Summit.

Dr Bandar Hajjar, President of the Islamic Development Bank highlighted the need for London with its world class financial services expertise to be at the heart of the “Islamic finance revolution” and for it to leverage its global marketplace to help realise the potential of Islamic finance.

He highlighted the continued global growth of the Islamic finance market, in particular the growth within the UK and cited the financial inclusion and shared prosperity model which is at the heart of Islamic finance transactions. The example of the IFFIm sukuk which raised over $500m for a global immunisation programme was cited as an example of the social impact investment on a grand scale.

The advantage of #Islamicfinance is that it promotes #risk sharing and links the #financial sector with the real sector. #Conferences like the #SukukSummit are important in order to secure long term #investment according to @IsDBPresident. @hmtreasury @MayorofLondon @Nyra_Mah pic.twitter.com/TIerirocUp

— IsDB Group (@isdb_group) March 7, 2018

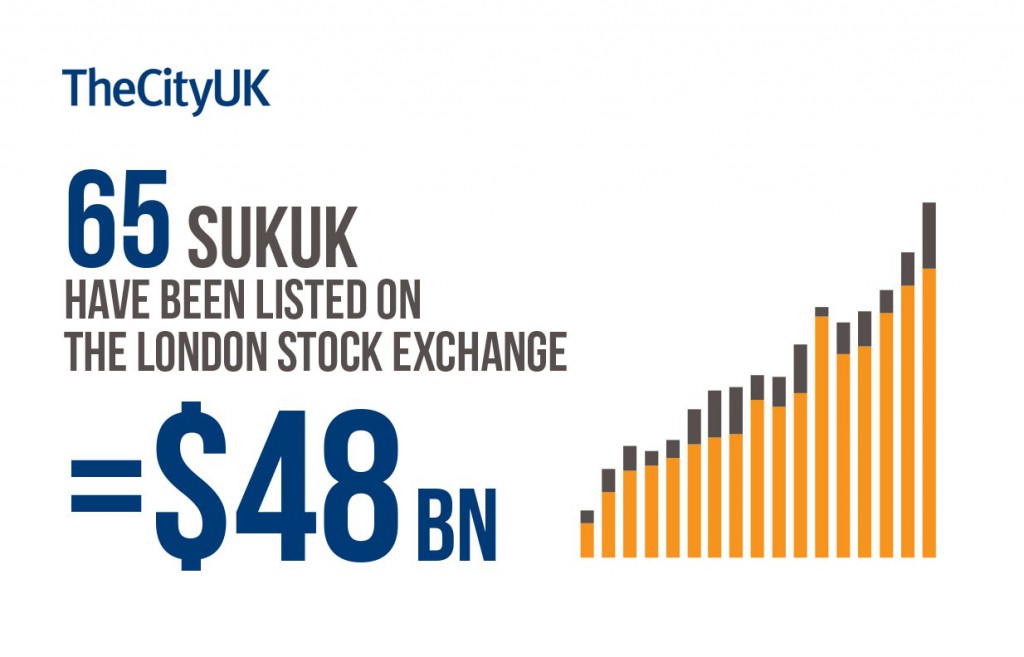

London Stock Exchange Sukuk Listings

The London Stock Exchange is home to a number of sukuk listings, with 65 sukuk having been listed on the London Stock Exchange valued at $48 billion.  Addressing the conference John Glenn MP, Economic Secretary to the Treasury and City Minister said “We have supported market-driven innovations in the field of Islamic FinTech. The government is determined to ensure this continues”

Addressing the conference John Glenn MP, Economic Secretary to the Treasury and City Minister said “We have supported market-driven innovations in the field of Islamic FinTech. The government is determined to ensure this continues”

Dr. Hajjar: We’ve seen a 20% growth in Islamic Banking over the last decade and $3.5 trillion in assets in 2017” #SukukSummit https://t.co/TeE1eBdxIt pic.twitter.com/S0cdrhWR4P

— IsDB Group (@isdb_group) March 5, 2018