Watch Out for Experts

Article Overview

I love business TV, and regularly watch CNBC and Bloomberg. The finance and economic shows are wonderful and a great resource of learning and getting a pulse of the market.

One thing which I believe needs to be toned down is the predication game. I get these channels have hours to fill, but would caution readers to take with a pitch of salt the stream of sorcerers who appear daily with their crystal balls and make false predications, no doubt leading to losses for people who happen to follow them.

Ask yourself when did truly legendary cross decade investors such as Warren Buffet or Ray Dalio make a specific recommendation on a single stock? The answer is never.

Do listen to experts, but be sure to determine for yourself if the person making predications is actually an expert, and do review their track record.

I’ve put together some of the predications made around this time last year, and cross checked the actual results which makes for fun watching. I focus on companies or investments which are considered investable as Islamic Equities forming part of Islamic Indexes, Islamic Investment Funds or would be classified as such based on a qualitative assessment.

Permissible Islamic Equities

Meta, the company formerly known as Facebook started the year at $338. In the below video, Stephanie Link, chief investment strategist at Hightower Advisors recommends buying it because its valuation is very attractive, and its “on sale”. Next, spokesman for now disgraced FTX , Mr Wonderful Shark Tank Kevin O’Leary stated Meta was a buying opportunity due to a recent pull back. Unfortunately for both of Stephanie and Kevin, Meta ends the year at $120, a 64% drop! 😟

Apple was selected by Morgan Stanley analyst Katy Huberty as its smart bet for 2022 and its share price started the year at $182. Daniel Flax of Neuberger Berman foresaw ‘substantial upside’ for Apple. Unfortunately for both, Apple ends the year at $129, a 28% drop! 😮

Nvidia was selected by Sarat Sethi, managing partner at Douglas C. Lane & Associates. Nvidia’s share price on 29 Dec 21 was $301, but unfortunately has ended the year at $146, down over 50%! Even worse was his suggestion to create a portfolio around Apple, Facebook (Meta) and Snap. We have seen above how Meta and Apple performed disastrously in 2022, but Snap is a special case which I saved till last. 😒

Rohit Kulkarni of MKM Partners selected Snap for the next 12 months as it’s a “leader in augmented reality”. Snap’s share price at the start of the year was $46.59, but ends the year at $8.81, down a whopping 81% for the year! 🤨

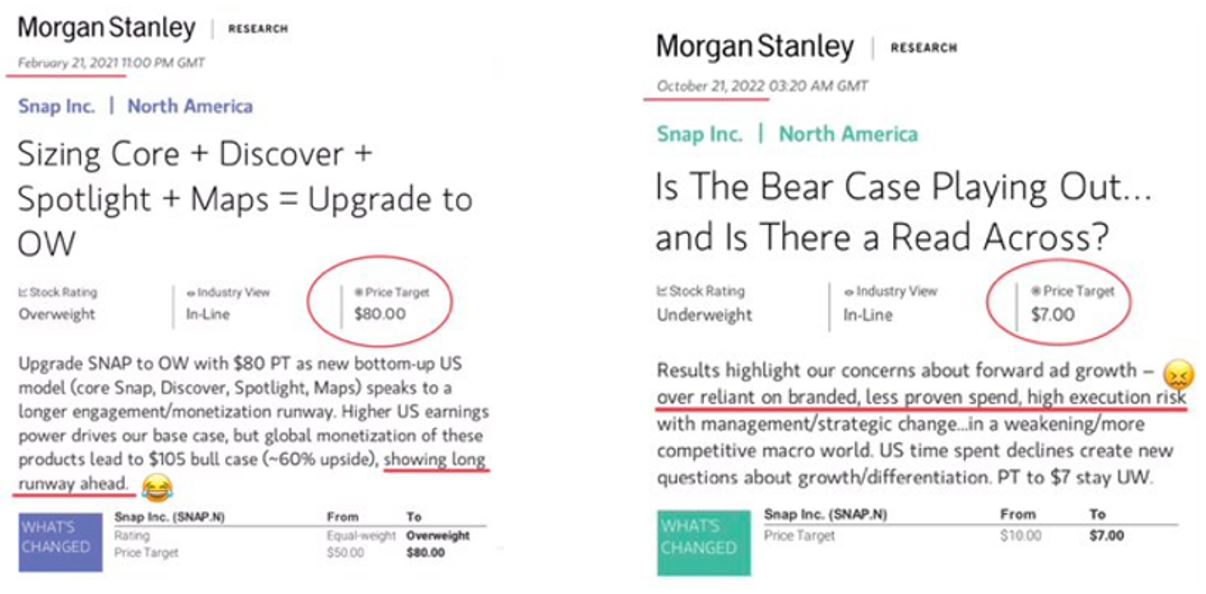

Rohit should have been looking at the reality of Snap’s balance sheet and income and not its “augmented reality” 😊, but being fair to Rohit he was not alone as Morgan Stanley was equally spectacularly wrong.

Take Away – The Lesson Learnt

Understand increasing your investment wealth is about spreading the risk, and not selecting individual shares in companies. No one knows what will happen tomorrow or during the next year, but there will always be sorcerers.

The best investment is to invest in yourself such as a training course or qualification allowing you to earn more.

For any excess money, investing in regulated passive index funds as opposed to individual companies is the choice of the respected experts. Taking the recommendations above, if an investor had bought a passive index fund, say FTSE 100 (using data of Vanguard FTSE 100 ETF (VUKE.L)) this time last year, the investment would have ended the year about flat, even with the roller coaster UK economy of 2022, but bagged 3.84% in dividends so finished up for the year. Most importantly the investment capital would have been preserved and not destroyed as the risk would have been spread across 100 companies and not just a single stock.

Combined with investing in a tax-free investment account (SIPP or ISA in UK) and having used dollar cost averaging to slowly enter the market over the year, you would have finished considerably up for the year.