![]()

Report by Malaysia International Financial Centre Report

Islamic Finance Supports Socio-Economic Development

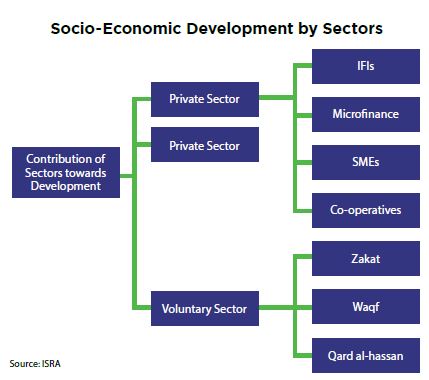

The financial sector plays a critical role in the socio-economic development of any country. Of importance, Islamic finance was designed as a just and ethical financial system, supporting the efficient allocation of resources both for wealth creation purposes, as well as the betterment of society. Islamic finance is expected to further enhance socio-economic well-being in countries in which it operates, both through supporting the financial needs of households and businesses in a Shariah-compliant manner; as well as through additional support via zakat, waqf and Islamic microfinance.

In line with the main aims of Islam, economic justice which has generally been known as critical in achieving financial inclusion is one of the main features of the Islamic financial system that should be given extra deliberation. It is noteworthy to inform that Islamic finance along with consequent product

innovation has boosted Islamic financial institutions (IFIs) ability to serve the economy through Shariah-compliant instruments.

Islamic finance being at a fairly embryonic stage, further progress can still be made to support the achievement of these goals. Going forward, the growth prospects of Islamic finance is expected to remain bright, which is expected to benefit socio-economic welfare developments in key Islamic finance jurisdictions. As such, Islamic finance is expected to further enhance socio-economic well being in countries in which it operates, both through supporting the financial needs of households and businesses in a Shariah-compliant manner; as well as through additional support via zakat, waqf and Islamic microfinance.

Download Report

![]() Socio Economic Development supported by Islamic Finance (1MB)

Socio Economic Development supported by Islamic Finance (1MB)