![]()

Commentary by RHB Global Sukuk Markets Research, Kuala Lumpur, Malaysia

Highlights and Performance

Article Overview

Saudi Arabia Sovereign Update: Net foreign assets contracted for four quarters in a row to USD664.4bn in Jun-15, falling by USD72.6bn since their peak in Aug-14; Expectations of higher government debt of USD5.3bn to reduce their elevated budget deficit amid falling oil revenues, continuing government expenditure and war in Yemen.

RHBFIC View: Neutral. Saudi Arabia has the lowest borrowings (2014: 1.6% of GDP) in the region, allows for the flexible issuance of domestic debt to buffer against IMF’s estimated budget deficit of USD130bn in 2015 (2015e: 20% of GDP; 2014: 0.6% of GDP) in the near future. The public spending/GDP ratio is likely to rise and would have negative impact on Saudi Arabia if this were accompanied by limiting credit expansion to private sector. Yields for ISDB and SECO were mixed -13bps to 7bps WoW.

Sukuk Trade Idea

Emirates Islamic Bank EIBUH 4.147% 11/1/18 (Baa1/NR/A+) (YTM: 2.345%; z-spread: 123.4bps) (Amount o/s: USD500m)

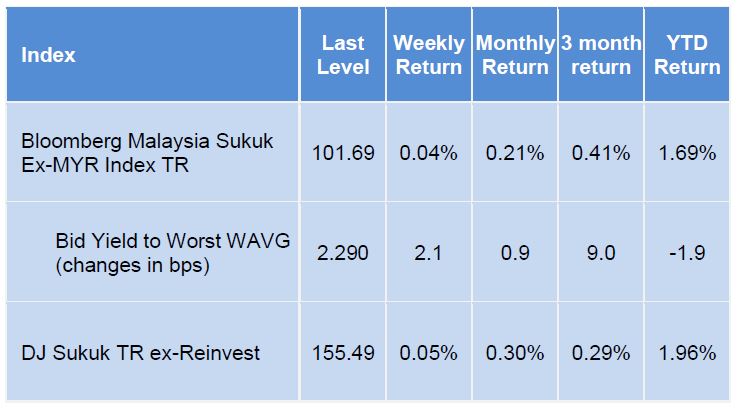

Marginal c.0.04% gain despite 2.1bps wider yields.

The Bloomberg Malaysia Sukuk Ex-MYR Total Return (BMSXMTR) was mostly flat (+0.04% W-o-W) at 101.69 (week prior: +0.06% to 101.65); however yields widened 2.1bps to 2.290% (week prior: -0.6bps to 2.269%). Gainers on the index were led by SECO 22-24, KFINKW 16 and QATAR 23 raising the Index’s value by USD11.5m; while FGBUH 16, MALAYS 21 & 25, RAKS25, and ISDB 17 wiped USD19.4m from the index. The Dow Jones Sukuk Total Return Index (DJSUKTXR) also rose by 0.05% to 155.49 (week prior: +0.05% to 155.42), pulling YTD gains up 5bps to 1.96% (week prior: +5bps to 1.91%).

Supply drought led to buying in extremes: low HY and high IGs.

With no fresh issuance since June, junk-rated DAMAC 19 tightened 20bps in yield to 6.12%, topping performance for a third straight week being the yieldiest USD sukuk (ASYAKA 23 aside which widened 7bps to 12.54% given its sliding earnings and links with Turkey politics). Other high yields that gained were PKSTAN 12/19 tightening 8bp to 6.06%; and banking Tier-1 perpetual sukuk ALHILA Pc6/19, ADIBUH Pc10/18, DIBUH Pc3/19 and DIBUH Pc1/21 tightening 3-7bps to yields of 4.75%-5.43%. Sovereigns were mixed with buying into high investment grade IFFIMS 12/17 and QATAR 1/18, both tightening 10bps to 0.4% and 1.3% respectively; while yields on UAE cities SHARSK 24 and RAKS 18 & 25 widened 5-6bps, and RAKS 16 being the weakest performer widening 14bps to 0.77%.

Default insurance for Malaysia, Indonesia and Turkey reached year-highs.

CDS spreads reached a 2-year high for Malaysia (+8.5bps w-o-w to 154) as its reserves and Ringgit dropped to ‘08- and ’98-lows following political and commodity concerns. Similarly, Turkey (+7.4bps to 246) and Indonesia (+7.0bps to 190) reached Mar-14 levels, as the former’s parallel wars weigh on growth and political stability, while the latter posted the slowest GDP growth since 2009 of 4.67% y-o-y (refer to Chart of the Week). Elsewhere, CDS was wider for Bahrain (+5.0bps to 280), Saudi Arabia (+2.5bps to 67) and Abu Dhabi (+2.0bps to 57); and flat for Qatar (60bps) given relatively lower breakeven oil prices, and Dubai (180bps) after removing fuel subsidies.

Risk from sustained recovery in US and weaker commodities.

US nonfarm payrolls was largely in line with expectations at 215k in July (consensus: 225k; prior: 231k, revised by +8k), which mildly supports a September rate hike. Just as Brent crude prices sank below USD50/bbl (before trading within the USD49-50/bbl range). And for Malaysia, its reserves fell to USDD96.7bn as at 31-Jul, below psychological USD100bn levels. We opine that these events weigh on the outlook for sukuk, particularly on the shorter term (similar to UST curve flattener with 2y yields rising and 10y dropping after NFP) and for lower-IG sovereigns.