Commentary by RHB Global Sukuk Markets Research, Kuala Lumpur, Malaysia

Flattish week for Sukuk; yields added 1.1bps to 2.36%

Article Overview

The Bloomberg Malaysia Sukuk Ex-MYR Total Return (BMSXMTR) closed flat at 101.63 (week prior: +0.04%, 101.63) while the Dow Jones Sukuk Total Return Index (DJSUKTXR) rose marginally by 0.02% to 154.58 (week prior: -0.16% to 154.55). The weighted average yield of BMSXMTR widened 1.1bps to 2.36%. Worst performers are FGBUH 16, MALAYS 21-25, RAKS 25, ISDB 17 for 3rd week in a row, shedding USD19.38m in market cap.

CDS for Malaysia, Indonesia and Turkey widened

The spreads rose 18.6bps for Malaysia to 183.3 as Moody’s and Fitch warn on downgrade risk, concern of further erosion of foreign reserves and political pressures. Similarly, Turkey (+14.85bps to 273.2) as heightened security risks and new election calls and Indonesia (+12.8bps to 238.8) after government delayed stimulus program. Elsewhere, CDS spreads tightened in Bahrain (-5.0bps to 290.0), Dubai (-5.1bps to 197.4), Saudi Arabia (-5.8bps to 85.0), Qatar (-2.4bps to 61.31), Abu Dhabi (-2.0bps to 61.5), for the second consecutive week as oil prices recovery above USD50/bbl.

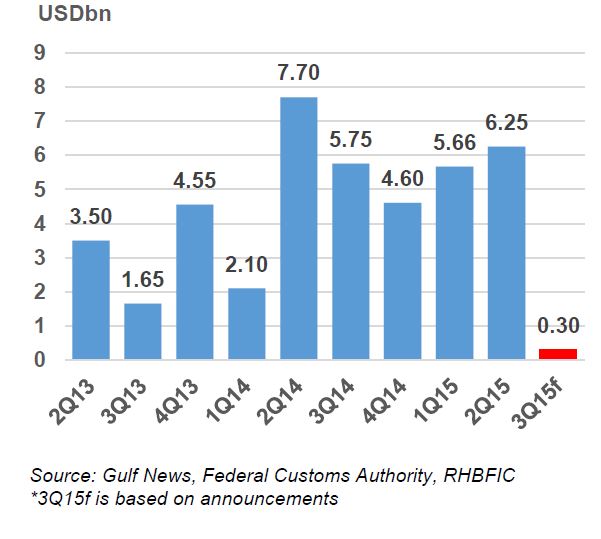

Fresh supply could re-emerge by end-3Q15

Supply may be sparked after a quiet two months as the International Finance Corp (IFC) may issue a mini sukuk of USD100m. In addition to this, SapuraKencana Petroleum issued a USD200m Commodity Murabahah (via Tawarruq arrangement) on 8 September where proceeds will be utilized to partly refinance its wholly-owned subsidiary SapuraKencana TMC Sdn Bhd’s (SKMTC) existing financing. Primary issuances in 3Q15 likely to be lower than USD5.75bn in 3Q14, given the cautious approach to the market given rising sources of uncertainties. Nevertheless, demand will remain resilient based on the still-healthy average bid-to-cover (BTC) ratio of c. 4.55x, albeit lower than last year’s 7x, based on our calculation.