As Islamic Banks Close, Assets and Profit Continue to Grow

Article Overview

Islamic Banks are experiencing mixed fortunes as the industry matures and consolidates whilst facing challenges competing against established conventional peers. Whilst some Islamic Banks are closing or integrating within larger parent banks, Islamic Banking assets and profits continue to show strong growth.

Following on from the recent decision of DBS Bank of Singapore to wind down its Islamic banking unit and integrate its Islamic finance offerings into its main operations, the International Bank of Azerbaijan stated this week it was closing its Islamic banking operations. The bank, 50.2 per cent-owned by the Azerbaijan Ministry of Finance, had began offering a Sharia compliant window operation in April 2013.

However assets and profits within the sector continue to grow with Bank Nizwa, one of Oman’s two Islamic banks stating earlier in the week its assets increased by 23 percent to OMR 316.4 million with customer deposits increasing by 146 percent to OMR 170.6 million. Also announcing this week was Qatar Islamic Bank which with $26.37 billion in assets is ranked as the sixth largest Islamic Bank globally (by assets) by IslamicFinance.com, reporting a 27 percent jump in third-quarter net profit to 514.9 million riyals ($141.43 million) in the three months to Sept. 30, compared with 404.8 million riyals in the same period a year ago, according to data calculated by Reuters.

The Islamic Banking Sector

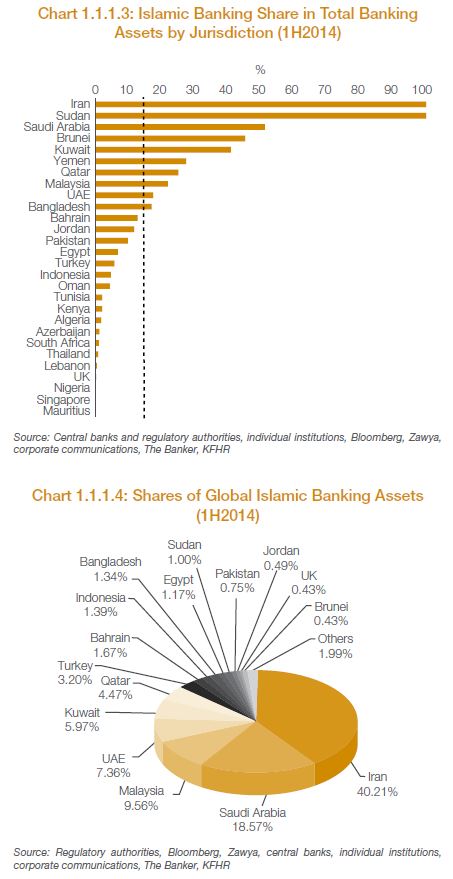

The majority of global Islamic Banking assets globally as located in Iran, Saudi Arabia and Malaysia according to data published by the Islamic Financial Services Board.

[interactive_graph]