Commentary by RHB Global Sukuk Markets Research, Kuala Lumpur, Malaysia

![]()

Sukuk continued into second week of gains

Article Overview

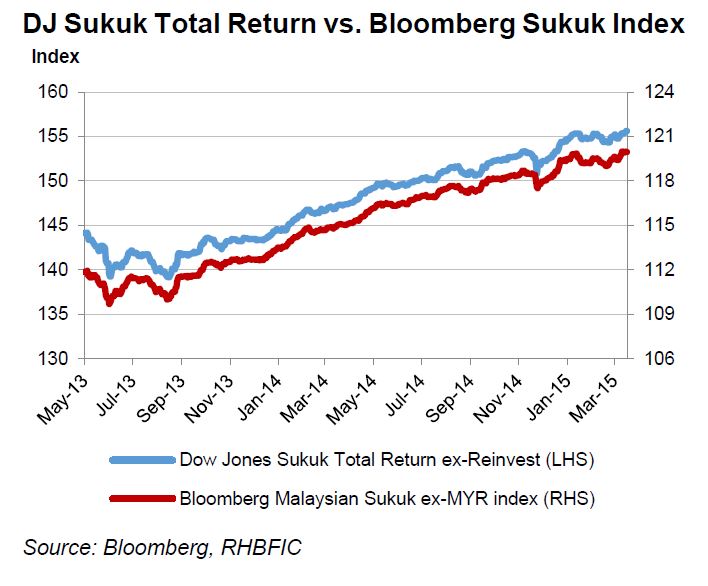

The Bloomberg Sukuk Market Return Index (BMSSUTR) inched 0.14% higher W-o-W (vs. +0.29% in week prior) to 119.96, bringing YTD returns to 1.50% (vs. 1.53% in week prior). The Dow Jones Sukuk Total Return Index (DJSUKTXR) rose +0.18% W-o-W (vs. +0.30% in week prior) to 155.62, bringing YTD returns to 2.05% (vs. 1.86% in week prior). Sukuk extended gains into a second week on stability returning to Brent prices (+2.9% W-o-W to USD56.57/bbl) after recent supply shocks. Similarly, yield volatility was spared in the region following the uneventful FOMC minutes and 10y UST reopening on Wednesday, while gaining some support from the much weaker than expected US jobs data (NFP increased by 126k in March vs. a downwardly-revised 264k rise in February) and widening 10y UST (+12bps to 1.95%). The top 5 gainers in the BMSSUTR during the week were SECO 24, SECO 23, SECO 22, RAKS 25, and ISDB 19 adding market value by USD2.7bn (prior: +USD3.5bn).

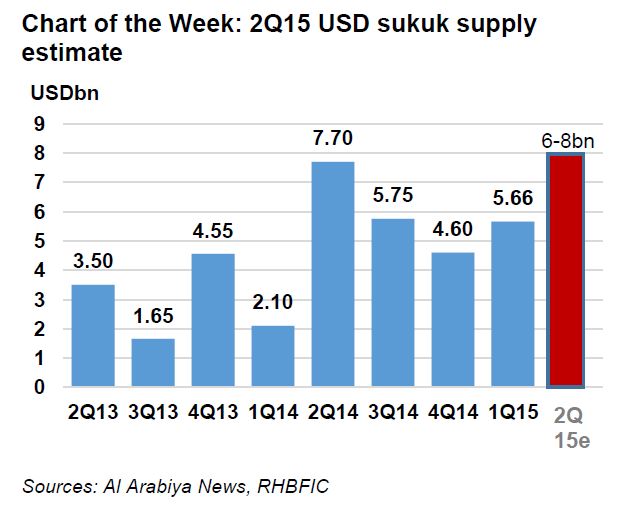

New Issuances in Q2

Going into 2Q15, we may see a flood of new issuances mainly from Asia, as tensions in the Middle East heat up. Malaysia kicked off roadshows while receiving a preliminary A- rating by S&P on 6 April for its proposed USD2bn issuance, mainly to redeem its USD1.25bn sukuk maturing in June. Elsewhere, we suspect other sovereign issuances from Indonesia (USD1.5bn), Ningxia province (USD1.5bn), Oman (USD300-400m) and Jordan (USD1bn). In addition to sovereigns, we should be seeing other names such as Qatar Islamic Bank (QIB) (up to USD1.37bn), Islamic Corporate Development of the Private Sector (ICD) (USD1.2bn), Cagamas (>USD500m) and Dogus Group (USD370m) during the quarter. We expect primary market supply in 2Q15 to range between USD6-8bn, similar to 2Q14’s USD7.7bn as issuers rush to lock in lower interest rates.