Revised Results

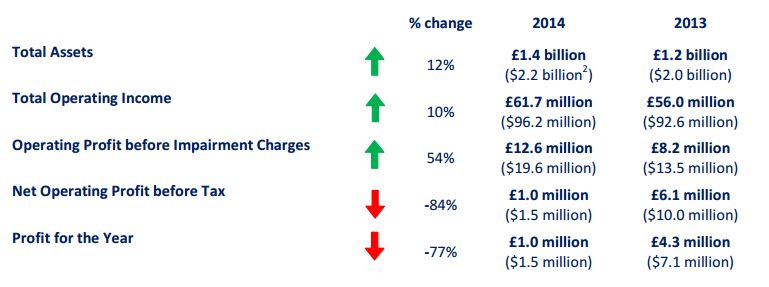

BLME Holdings plc announced its revised full year financial results to 31 December 2014. BLME reported a Profit for the Year of £1.0 million and an Operating Profit before Impairment Charges of £12.6 million, a 54% increase from £8.2 million in 2013.

Humphrey Percy, CEO of BLME, commented on the results: “Whilst I am disappointed that a material credit loss has occurred, these results demonstrate that in a competitive market environment BLME can significantly expand and increase underlying profitability while containing expenses and developing the Bank’s infrastructure. BLME has continued to gain recognition for its expertise in Islamic finance and its commitment to broader industry development. It has maintained its position as the largest Islamic bank in Europe and continues both to broaden its product offering and to bring its distinctive range of financial solutions to clients in both the UK and the GCC. BLME is committed to growing the Asset Management business and in 2015 will be investing in and focusing the distribution team in the Dubai office. BLME has much to be proud of, and our business is well positioned for the future as we continue to develop a long-term sustainable business.”

Other Highlights

Other highlights of the full year results are:

• Number of depositors increased to 5,587 over the period.

• Net fee income increased by 40%.

• Cost to Income ratio continued its downward trend from 76.5% to 72.3%, as business growth continues.

• Capital adequacy ratio maintained in excess of current and impending Basel III standards.

Download Full Results

![]() BLME Holdings plc 2014 Full Year Results Presentation.

BLME Holdings plc 2014 Full Year Results Presentation.

About BLME

Launched in 2007 with offices in London and Dubai, the Bank of London and Middle East (BLME) is an independent UK bank with strong links to the GCC. It is listed on the NASDAQ Dubai and is the largest Sharia compliant bank in Europe acting as a specialist finance provider to UK mid-market corporates, as well as taking deposits.