Khazanah hits the road to market its dollar sukuk and analysts expect the state investment fund will need to offer premium yields to entice investors. »

Takaful is an important growing sector in the Islamic finance industry, with continuous positive growth momentum in key markets and estimations of continued double-digit growth globally. While the GCC and ASEAN are expected to continue to lead the global takaful markets with their substantial growth, emerging markets within Europe and Africa are also showing significant growth potential. »

A notable feature of the Malaysian financial sector is the dual system of conventional and Islamic finance. This system was established pursuant to a strategy that had the objective of promoting an inclusive financial system and of strengthening linkages between the financial system and the real economy. »

The increased participation of non-Muslim jurisdictions also reflects the positive acceptance of Islamic finance among the global community. Sukuk has drawn strong interests as an attractive source of funding and a new asset class. »

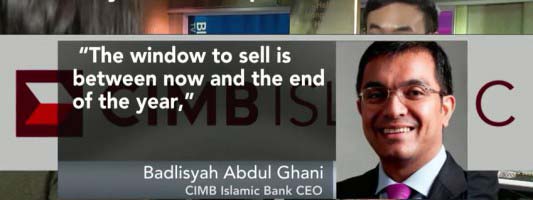

Islamic bond issuance in Malaysia over the last three months marked its slowest quarter since 2010. Bloomberg TV Malaysia's Sophie Kamaruddin and Han Tan look at the factors that could mark a turnaround by year-end in the world's largest sukuk market. »

Raja Teh Maimunah, CEO of Hong Leong Islamic Bank, in an interview with Bloomberg stated that Malaysian Islamic banks need to merge to achieve economies of scale, and that the prospects of a possible merger are always on the table. She also explains the potential for growth in digital payments, especially in Vietnam and Indonesia as well as witnessing slower growth in Malaysia. »

Spreads on 10 year Malaysian sukuk over conventional have more than halved since being added to the Barclays Capital Aggregate Bond Index. Malaysia's Shariah-compliant government investment issues were included in the Barclays Global Aggregate Index on March 31, with a weighting of 0.18 percent. At the time of the announcement it was estimated the move would attract at least $2.5 billion to $3 bil... »

Report presents the output of two-year collaboration between the Centre for Islamic Economics, IIUM and the Statistical, Economic, Social Research and Training Centre for Islamic Countries (SESRIC) on a research project that covered three OIC member countries namely, Malaysia, Indonesia and Bangladesh. »

Demand for funds by Malaysian infrastructure companies is driving up sales of Islamic bonds. Ringgit-denominated sukuk issuances are set to hit their highest quarterly levels in more than a year. Bloomberg TV Malaysia's Sophie Kamaruddin and Han Tan discuss the factors driving the recent rise. »

Having pioneered and lead the world in modern Islamic Banking and Sukuk, Malaysia is now trend setting in the area of Islamic pensions. »