The decision by DBS Bank of Singapore to wind down its Islamic banking unit and integrate the specialist skills of its Islamic finance bankers into its main operations signals new levels of maturity for the Islamic finance industry. Islamic finance sits stronger as part of the total, not a sum of the parts and the move by DBS reflects tighter integration of Sharia compliant financial services, whi... »

The Bloomberg Malaysia Sukuk Ex-MYR Total Return (BMSXMTR) closed flat at 101.63 (week prior: +0.04%, 101.63) while the Dow Jones Sukuk Total Return Index (DJSUKTXR) rose marginally by 0.02% to 154.58 (week prior: -0.16% to 154.55). The weighted average yield of BMSXMTR widened 1.1bps to 2.36%. Worst performers are FGBUH 16, MALAYS 21-25, RAKS 25, ISDB 17 for 3rd week in a row, shedding USD19.38m ... »

International law firm Clifford Chance advised International Company for Water & Power Projects (ACWA Power) on two syndicated commodity murabaha-based transactions to add another SAR1.109 billion (US$295 million) to its revolving shari'a compliant working capital facilities. »

Raja Teh Maimunah, CEO of Hong Leong Islamic Bank, in an interview with Bloomberg stated that Malaysian Islamic banks need to merge to achieve economies of scale, and that the prospects of a possible merger are always on the table. She also explains the potential for growth in digital payments, especially in Vietnam and Indonesia as well as witnessing slower growth in Malaysia. »

SapuraKencana Petroleum, Malaysia's leading oil and gas company, announced it had issued $200 million worth of sukuk on Tuesday to refinance some of its debt. The issuance, the first tranche of a multicurrency, medium-term notes program, is being offered through wholly owned subsidiary SapuraKencana TMC. The deal was priced at 4.85% with a seven year maturity and marked a rate foreign currency suk... »

Spreads on 10 year Malaysian sukuk over conventional have more than halved since being added to the Barclays Capital Aggregate Bond Index. Malaysia's Shariah-compliant government investment issues were included in the Barclays Global Aggregate Index on March 31, with a weighting of 0.18 percent. At the time of the announcement it was estimated the move would attract at least $2.5 billion to $3 bil... »

Sukuk supply is picking up after recent sovereign announcements by Jordan and Indonesia, as well as a slew of announcements from Malaysian and Turkish corporates and the AAA rated Supranational International Finance Corp, part of the World Bank. »

If you want Sharia-compliant finance to be ethical, then let´s hold ourselves true to our word and discuss substance in the industry. Qatar is well determined to finance most of its infrastructure for the World Cup the Islamic way, yet it is not prepared to abolish what has been called modern slavery, the “Kafala”- System, without Western pressure. What about child labour? Let us discuss Banglades... »

In an interview with the African Leadership Network, Lamin Manjang, CEO Standard Chartered Kenya stated the Kenyan government has previously stated it wishes to go down the route of a sovereign sukuk issuance, and that Standard Chartered Kenya is leveraging off the banks international experience in issuing sukuk to assist the Ministry of Finance. »

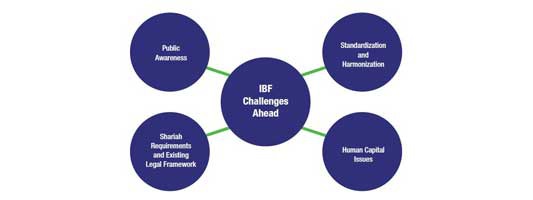

In just four decades, the Sharia compliant finance industry has grown from a niche banking system to be regarded as one of the fastest growing segments of the global financial industry, with total global financial assets estimated to be around USD2tln. The past five years have been most significant, recording 17.3% Compounded Annual Growth Rate spurred by improved industry infrastructure, a more c... »