GCC Market Update by Rasameel. Over the last month banks in the UAE have preferred conventional bonds issuance whilst Saudi banks have taken the Sukuk route. »

Short Term Sukuk is Recycled money and does not equate to a market Correction. Bank Negara has been in previous years been a prolific issuer of short-term sukuk, which by its very nature is short dated paper with maturity dates of less than one year. It is misleading to use such sukuk to accurately represent market demand as such short term sukuk are re-issued multiple times through-out the year. »

In an UK government innovation, this week saw delivery of the fourth and final Airbus A380 aircraft to be funded under the world’s first corporate sukuk to be guaranteed by a western government. The aircraft was delivered to Emirates this week at Hamburg Airport with the bond guaranteed by UKEF. »

Financial Inclusion is a hot topic in developing countries. To maintain growth the industry needs to reach and acquire large swathes of unbanked populations. Account penetration rates in key regions such as the Middle East, Sub- Saharan Africa and South Asia remain fairly low. In the Sub-Saharan African region, amongst the 34% of adults with an account, almost a third of account holders – or 12% ... »

A sub-sector of Islamic Banking which has not evolved as fast as the rest of the wider Sharia compliant financial industry is Islamic Asset Management. $3-4 trillion of wealth may be looking for a Sharia compliant home according to John Sandwick of Safa Invest, who sees potential in development of Islamic Asset Management sector. »

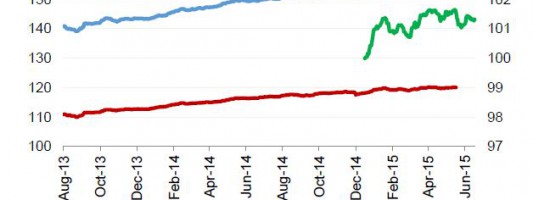

The Bloomberg Malaysia Sukuk Ex-MYR Total Return Index (BMSXMTR) inched lower by 0.05% during the week to 101.3 (vs. -0.02% to 101.38 in week prior). The Dow Jones Sukuk Total Return Index (DJSUKTXR) also dropped by 0.18% W-o-W to 154.7 (vs. +0.11% to 155.0), lowering YTD gains by 18bps to 1.46% (vs. +12bps to 1.65%). »

An IMF working paper examined key features of modern public debt management legal frameworks and took a specific look at Sukuk legal frameworks in the UK, Turkey and Luxembourg. »

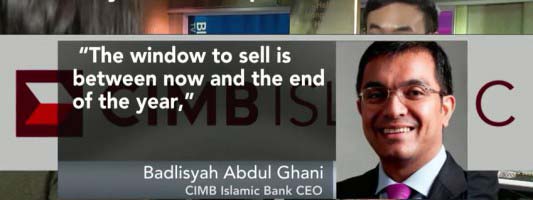

Demand for funds by Malaysian infrastructure companies is driving up sales of Islamic bonds. Ringgit-denominated sukuk issuances are set to hit their highest quarterly levels in more than a year. Bloomberg TV Malaysia's Sophie Kamaruddin and Han Tan discuss the factors driving the recent rise. »

“Sharia Law” is a phrase which elements of the media in the West have made synonymous with beheadings, stoning to death, the chopping off of hands, banning women from driving and education, full-face veils, intolerance and the like. Such arguments fail to understand there is no single version of Sharia Law which worlds 1.6 billion Muslims follow. Sharia Law varies greatly from country to country. »

Having pioneered and lead the world in modern Islamic Banking and Sukuk, Malaysia is now trend setting in the area of Islamic pensions. »