William Engdahl during an interview with Sean Stone on LipTV, alleged the war in Libya was fuelled by motivation to overthrow Muammar Gaddafi as he planned along with Tunisia and Egypt to create an North African Supranational Islamic Development Bank "free of the dollar". »

Covering the major modern milestones of the development of the modern financial industry, from Mit Ghamr Bank to the UK Sovereign Sukuk. »

Turkish Deputy Prime Minister Ali Babacan speaking at an IMF discussion emphasised the universality of finance based on Islamic value for all of man-kind irrespective if the customer is Muslim or not. »

Whilst Islamic financial services continue to display strong growth and nears $2trillion in assets, the growth is in part failing to create sufficient economic activity to lift the poor out of poverty. Futile financial engineering to create socially useless Sukuk such as the Goldman Sachs issuance does little to help the 322 million people living on less than $1.24 per day. »

The growth of the industry offers important potential benefits, the IMF stated in its IMF Research June 15 bulletin. The IMF stated the sector could facilitate financial inclusion by increasing access to banking services to underserved Muslim populations. Furthermore the risk-sharing characteristics of Islamic financial products can facilitate access to finance by small- and medium-sized enterpris... »

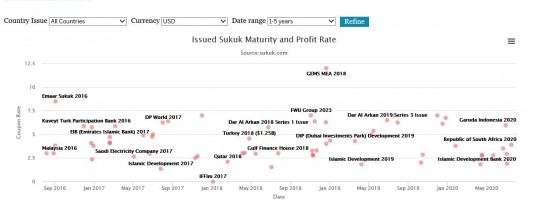

The leading Sukuk platform, Sukuk.com have released the Sukuk Chart Dashboard; a powerful visual tool providing free access to issued Sukuk data. The dashboard, which is available on the homepages of Sukuk.com and IslamicFinance.com, allows users to view issued Sukuk based on their maturity and issued profit rates along with corresponding information covering issued amount and date as well as its ... »

For YTD May 2015 sukuk issuance by value declined 46% y-o-y to USD7.0bn, mainly driven by a sharp decline in sovereign issuances (-40% y-o-y), corporate (-48%y-o y) and quasi sovereign issuances (-55%y-o-y). Corporates comprised 47% of the total issuance value for YTD May 2015, followed by sovereign at 39% and quasi-sovereign issuances at 14%. »

Mr Mutallab called on the Central Bank of Nigeria to support the operation of the non interest banking segment of the banking sector through the provision of shariah complaint financial instruments. »

The Islamic Reporting Initiative, launched last month and headquartered in Dubai, has just acquired a new strategic partnership in the form of the Social Stock Exchange. »

Language skills and local knowledge from Azerbaijan are better suited to assist Russia. »